Understanding How Debt Consolidation Affects Credit Score

Last Updated: September 11, 2022

It’s common knowledge that eliminating debt improves your credit score and financial situation. To eradicate it, we use what resources we have available. If you possess a significant amount of debt, you may be considering debt consolidation. After all, it sounds like a sensible way to get a handle on your finances. Unfortunately, the way that debt consolidation affects credit score is not fully explained before you sign up. By the time you see, if debt consolidation will ruin your credit score, it may already be too late.

Table of Contents

Understanding the Mechanisms of Debt Consolidation

Debt consolidation works in the following manner. A consumer in financial distress contacts a debt consolidation company. They discuss the consumer’s financial situation, including any debt they hold. They plan to eliminate debt by taking out a debt consolidation loan over 2-5 years. This new loan is expected to cover the cost of the consumer’s bills.

Debt consolidation companies claim to provide a few benefits. For one, you have fewer payments to make per month, and, therefore, not as many deadlines to juggle. You also have to deal with fewer creditors contacting you for payment. The interest rate for your new loan may be lower than your previous rate. Your monthly payment could be lower than the total of your previously unconsolidated payments.

There are disadvantages. Not every creditor may want to accept a lower payment, and their debt obligation will be excluded from consolidation. You will either have to try negotiating with them or pay as originally agreed. It is easy to misuse the current credit and run up high balances again. Remember that low-interest rate? Well, you may still pay more in interest over the length of the debt consolidation loan.

Boosting Your Credit Score with Debt Consolidation

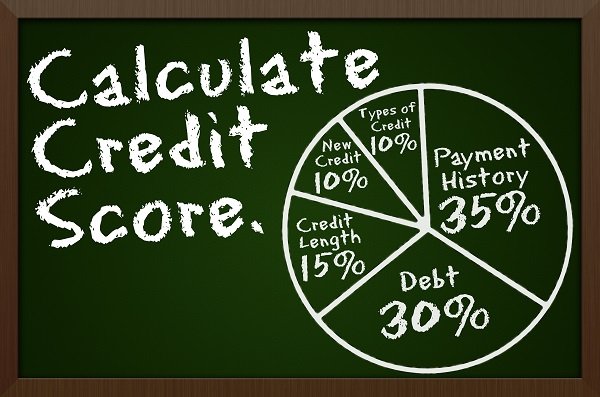

Deb consolidation is rare, but possible, to help your credit score. Debt consolidation can help you make payments on time for your monthly bills. Recall that payment history is worth 35% of your score. Selecting debt consolidation can influence more than 1/3 of your credit score.

The amount of credit you use compared to your total credit limit is called your credit utilization ratio. In general, you want this ratio to be 30% or less since percentages higher than this make lenders nervous. Consolidation can be used to pay down your credit card balance so that your utilization falls within this range. Your utilization ratio directly affects 30% of your credit score. With your payment history, you can control 65% of your credit score with debt consolidation.

There are other situations where debt consolidation may make sense. When your only accounts are revolving credit cards, it can benefit you to consolidate this with an installment loan. This could be a personal loan. The diversification of debt affects an additional 10% of your score. Debt consolidation is helpful when dealing with the original debt’s root cause. This increases the likelihood that you will successfully pay down your balance and keep it low.

How Debt Consolidation Ruins Your Credit Score

All too often, debt consolidation harms, not help your credit score. Missing one payment will result in a steep decline (recall payment history’s weight on your score). Do not use the debt consolidation period to apply for multiple credit offers. Chances are you will not qualify, which will ding your score even more. Opening new accounts is worth 10% of your score, a much smaller part of payment history or utilization.

Your utilization will be hurt in some ways. Concentrating multiple credit card balances onto one credit card can easily exceed your credit limit. This blows up your credit utilization, and now you’ve negatively affected 30% of your credit score. Some debt consolidation companies may require that you close credit lines as part of a debt management plan. Closing these will reduce the total amount of credit available across all accounts, detracting from your utilization. Another action that may damage your credit utilization is adding fresh debt onto recently cleared cards. If you can pay off the balance by the end of the billing period, it’s not a problem. Otherwise, your utilization begins to rise again.

Think Twice before Consolidating Your Debt

If you can use debt consolidation to achieve your financial goals, it makes sense to consolidate debt. Some reasonable goals include reducing interest rates or moving to a lower monthly payment. Ultimately, your goal is to have a high credit score. In the short term, you may choose actions that will lower your score to save money through lower interest payments. The additional benefit of paying off the loan faster this way may be. The payoff is that the consequences of debt consolidation last at least a year longer than the process itself.

Even if your goal is achievable, you may want to reconsider using debt consolidation. Letting your credit score dive into making a large purchase is not a good idea. You may want to wait until after to consolidate your debt. If financial life is in shambles, this is not the time to use debt consolidation. You are likelier to take on more debt in this state of affairs. It’s advised to wait until you have managed your financial state better before using this service.

Consider Debt Consolidation Alternatives

If debt consolidation sounds less of a good option, here are a few more solid options.

Make your own get-out-of-debt plan (and stick to it)

With some research and effort, you can design a custom-made plan to eliminate your credit card debt. Several credit card calculators are available to help you develop a way forward. You can calculate how much you can save, how long it will take to pay, and your total monthly payment. Using this information, you can create a monthly budget to help keep you on track.

You can also combine this with several ways to pay off debt. Two of the most popular methods are the snowball and high-interest methods. With the snowball method, you first pay off the smallest debts, gaining momentum to tackle the big debts. It’s popular because you tend to zero out more debt balances faster than other methods. The high-interest method has you first apply payments to the debt with the biggest interest rate. As you eliminate the high-interest rates, your debt becomes less expensive. Soon you’ll be left with the debt that has the lowest rates.

Negotiate directly with your creditor

Some creditors are more flexible if you work with them without involving a third party. Give them a call and explain your situation to them. They may have a hardship program for borrowers for which you can qualify. In some cases, the program may be free.

See if Chapter 7 bankruptcy is right for you

Some experts believe that Chapter 7 bankruptcy offers a better way to reset your financial situation than debt consolidation. There are some immediate shocks to your credit score, but it may be cheaper than other methods. It is also resolved faster, with most Chapter 7 proceedings completed within 3-6 months. You can immediately begin repairing your credit upon completing the bankruptcy process.

Other loan alternatives (if you qualify)

There are several other loans you may be able to use. Be cautious if taking out a loan to pay off another, since you are increasing your debt obligation.

A home equity loan/line of credit/second mortgage uses the equity in your home as collateral for a new loan. You will get better rates but require a FICO credit score of 660 or higher. If you are still paying your first mortgage, you will have two. Fall behind on these payments and your house is in jeopardy.

Cash-out refinancing works similarly to a home equity loan, but you only have one payment to one lender. You refinance your current mortgage and have access to up to 80% of the home’s value in cash. The credit score you need to qualify is 620 or higher. Like the home equity loan, your house is on the line if you fail to meet the payments.

Another option is a balance transfer credit card. You may transfer your debt to a card with a low or 0% APR. This APR is temporary, and you are advised to pay off your debt before the deadline. Failing to do so will cause rates determined by your credit score to be applied to the card.

Two things we don’t recommend at all are debt settlement and credit counselling. Despite being advertised as better solutions than bankruptcy, they are much worse. The financial effects of these two actions can last up to 5 years. Worse, it takes another year to rebuild your credit before lenders will even consider doing business with you again.

Be Careful

Now you know how debt consolidation affects credit scores. Can debt consolidation hurt your credit score? Yes, and the negative effects of it may devastate your financial foundation. Carefully and thoroughly reconsider whether debt consolidation is your best option to get you out of financial distress. You can get the same assistance from one or more alternatives that will damage your credit score less than debt consolidation.

I just finished with my MBA and ready to start tackling my student loan debt. I was thinking consolidate and get on an incom driven payment plan. I’m thinking of ways that I wil be able to pay my student loan while still paying rent/mortgage and living everyday. I must almost I’m a bit stressed trying to figure it all out.

You’re on the right track. Either consolidate and get income driven plan or keep them separate and get on Income driven plan.

See what rates are cheaper you don’t have to consolidate all of your loans. If you have low interest loans keep them and if you have higher interest loans they usually do an average, so consolidate those and you might save some $$ but you can be on an income based plan regardless. Also, if you’re ever considering loan forgiveness they go by consolidation date if you’ve consolidated not the original loan date so that might make you lose time

how does loan forgiveness work? Thank you for the info!

well if you work for the government, as a teacher or for a non-profit for ten or more years you can apply for it. You can look up the qualifying employment.

I think loan forgiveness doesn’t work for Graduate programs. Your best bet is to keep loan interest loans as long as possible, while you use your MBA to find a great source of income and when the cash flow is good, you can put down the loans.

Here’s to getting serious about being debt-free! This week I stopped at my credit union, got a personal loan with a FANTASTIC interest rate, and consolidated all of my debt with that loan. Now I have ONE payment each month and my debt pay down seems much more manageable. While I was there, I had them lower my CC limit with them from $26,000 (what the heck?????) to $5,000, and today I canceled 4 other cards. My goal is to have that personal loan paid in half by the end of the year, if not in full. It feels great… Read more »

How much debt did you consolidate and is your payment manageable?

About $14,000. Payments are around $336/month.

Incredible steps you took toward freedom! Is your credit score pretty good for them to work with you in a personal loan with a good interest rate?

yes, thankfully. It was touch and go at first, but once I had them lower that limit in my card, the loan officer approved it. Also, I do only work part-time right now, so that was a concern too for them.

Is it a better idea to get a personal loan to pay off others then pay that off? I have my car payment monthly and hearing aid payments monthly and I feel that this would be a good idea for me! More manageable. How would I know if I’m spending more in the long run though?

for me I was able to lower my interest rate by a good bit, and with the cards I do have left having a zero balance, I am less likely to use them because it’s so nice seeing ZERO. I do NOT want to see balance like that again and I don’t feel the stress of trying to pay on multiple balances every month. I can also throw extra money towards that balance it I want with no penalty.