Debt Counseling Services: Should You Use Them?

Updated: September 11, 2022

Many people have difficulty managing their financial situation. Overdue bills are a constant source of worry. They live paycheck to paycheck. When someone is in this situation, debt counseling services (also known as consumer counseling services) sound like a responsible choice. They are advertised as a long-term solution to get your finances back on track by developing better habits.

In practice, consumer counseling services sometimes present more harm than good. They target consumers so deep in debt that they think they have no other options. They often charge excessive fees on top of what the consumer owes. Debt counseling often doesn’t shield your credit report and credit score from negative results. Please, carefully consider all other available options before pursuing debt counseling services.

Table of Contents

What Is Debt Counseling?

Debt counseling is a service offered to consumers suffering from financial difficulties. The customer meets with a debt counselor who assesses their debt and other finances to develop a plan. Part of the strategy may involve the counseling company negotiating with your creditors to have them accept a lower amount. They will also attempt to minimize you late fees and reduce interest rates.

Debt counseling may destroy your credit if it is not legitimate. Besides, this service may not be free or affordable. Disreputable companies will tell you that their services are an alternative to bankruptcy and that it leaves your credit unaffected. These companies might coerce you into making donations to their non-profit, which adds to your debt problem. They may tell you that you should stop paying your creditors and pay that money to the agency instead.

Advantages and Disadvantages

A reputable credit counseling organization will provide free information about themselves and their services. You will not be obligated to share your information until you want to do so. The National Foundation for Credit Counseling (NFCC), and the Better Business Bureau can advise of reputable programs in your area. The U.S. Trustee Program is another trustworthy resource.

There are a few advantages to credit counseling:

- No filing bankruptcy.

- Your bills are combined into a monthly payment for the next three to five years.

- Your credit should stay the same before and after enrollment. (In practice, consumers have reported that this is not always true.)

- You learn to live according to a strict monthly budget.

However, sometimes the risks outweigh the benefits. They include:

- It works about 50% of the time. Half the consumers in a program drop out, according to the NFCC.

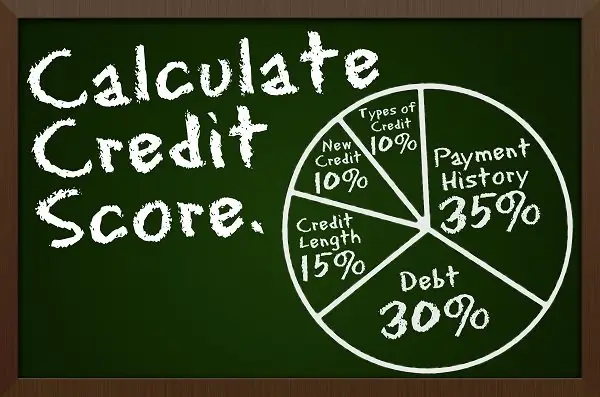

- It may destroy your credit score. Payment history and utilization ratio are negatively affected by consumer counseling and are worth 65% of your score. When you don’t pay your bills (or pay them on time) your credit score is quickly and sharply reduced. While you’re not paying your bills, your accounts are still accruing interest and late fees. This is separate from the fees that the credit counseling agency will charge. All this additional debt will increase the amounts you owe.

- The ruined credit score will make it expensive to get credit later.

- The negative remarks associated with credit counseling will stay on your credit report for seven years.

- You’re still a credit risk to lenders. The fact that you are in credit counseling shows up on your credit report. Most lenders would prefer to only work with you a year after you completed credit counseling. By then, you should have re-established better credit.

- Not every creditor will allow joining the credit counseling payment program. There is no guarantee that the creditor will take your credit counselor’s offer. In that case, you will still have to pay them separately.

- Credit counseling may affect how employees see you as a candidate.

The Very Slim Criteria Where Credit Counseling Is a Smart Option

If you’re in a tough situation fiscally, you can benefit a no-obligation discussion with a credit counselor. You can also gain insight from consumer counselors if you’ve been denied a loan, or are making a large purchase. However, you can usually perform these same activities by yourself with a little research. The internet is filled with articles from reputable agencies who can provide you with sound financial advice. You can call creditors directly and attempt to negotiate lower payments or a lower interest rate. Building a strict budget isn’t difficult (although sticking to it may be).

If you are considering consumer counseling, you may be a good candidate if you have all of the following:

- Steady income that is large enough to cover your living expenses and your new debt payments.

- Debt-to-income ratio above 15%.

- Your debt still being handled by the original creditor and is not in collections.

Even if you meet all these criteria, we recommend that you consider all other options. Choosing an alternative may be a better selection for your credit and can help you avoid all the disadvantages above.

If you choose this option, carefully scrutinize the contract before you sign. Your contract should list:

- All fees and financial contributions

- A payoff schedule

- The services you requested

- Termination policies

- How disputes will be handled.

If there is anything you don’t understand, ask questions until you get clear explanations. Ask if these answers can be included in the contract, perhaps in the definitions, annex or appendix. Do this before signing anything.

Make Wise Decisions

We know you want to be responsible and pay off your creditors. Be aware of all possible dangers and risks while choosing a debt counseling service. Consider all the alternatives and be wise in your choice.

I wonder if I have a good credit score this year, and won’t do anything the next year how will it change?

If you don’t do anything for a year (as if you don’t use your card)your score may become stagnant instead of growing higher, but it won’t start decreasing

It should just stay the same, which is totally fine. You could keep growing your available credit, to just improve your utilization ratio