Full Guide to FICO Score Calculating

You’ve probably heard about your FICO score (also known as your credit score). Banks use it; credit card companies use it; sometimes even your landlord and employer may use it. It’s a pretty important number. We may not have the exact method to calculate it, but you can get a pretty fair estimate of where your number lies.

Table of Contents

What Is a FICO Score?

Before 1989, accessing credit was a non-objective process. People were granted credit depending not on their ability to pay back the loan, but on prejudicial, non-credit factors. These included demographics like one’s race, marital status, gender, employer, and income. If the lender was someone with pre-determined biases against one of these demographics, the applicant would be in trouble. He or she would either be denied or be made to pay a huge penalty.

The Fair Isaac Corporation (FICO) introduced the FICO score as an unbiased solution to assessing a credit application. It removed the demographics from the assessment, in accordance with the Equal Credit Opportunity Act. A FICO score is a standard calculation that all lenders use. Lenders use your FICO Score, plus your credit report, to determine if you make a good credit risk. Your FICO score ranges from 300 (Very Bad) to 850 (Excellent). A good score is anything between 701 and 750.

How Is It Calculated?

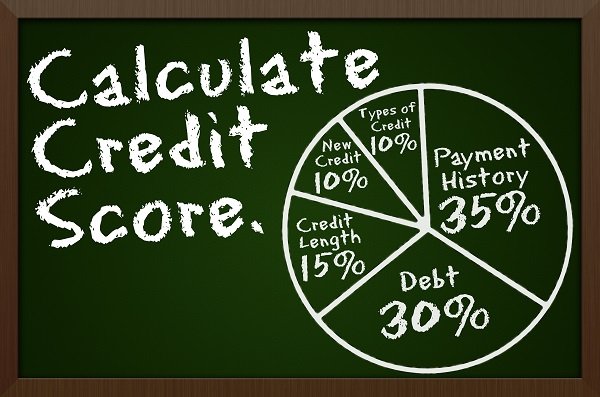

However, we can estimate our credit card risk using five factors and the relative percentage weight of importance. The first factor is payment history, and it is worth 35% of your credit score. Lenders want to see if you pay your bills on time. They also want to see how many late payments you have on your loan, and how late were those payments.

The second factor is the amount owed and it’s worth 30% of your score. A larger debt is of greater concern than a smaller one.

The length of your credit history is the third factor and it’s worth 15% of your credit history. This considers your average credit history, and not your chronological credit history. For example, opening a second credit card two years after your first credit card drops the length to one year. This factor also looks at how long it has been since an account was used.

The fourth factor is new credit and it looks at how often you have opened new accounts.

Finally, the type of credit used considers whether you have a healthy mix of loans or only one type. Both new credit and type of credit used are each worth 10%.

Recently, the Fair Isaac Corporation issued a chart that shows different attributes of each factor affecting your credit score.

FICO Scoring System

| Factor | Attributes | Points |

|---|---|---|

| Payment History | No record 0-5 6-11 12-23 24+ | 75 10 15 25 55 |

| Amount Owed | No record 0 1-99 100-499 500-749 750-999 1000+ | 30 55 65 50 40 25 15 |

| Length Of Credit History | Below 12 12-23 24-47 48+ | 12 35 60 75 |

| New Credit | 0 1 2 3 4+ | 70 60 45 25 20 |

| Type Of Credit Used | 0 1 2 3 4+ | 15 25 50 60 50 |

The score is broken down into the five factors above, with a scoring system for calculating the worth of each attribute. You can get a better estimation of how a changing factor will affect your score using this chart. For example, reducing your average outstanding revolving debt from $900 to $700 will raise your score by 15 points. Opening three credit cards within 6 months will drop your score by 45 points.

Factors That Influence Your FICO Score

Your FICO score can change depending on what financial actions you take. Remember that 35% of your credit score is dependent on payment history. The single most important thing you can do is pay your bills and payments on time. Late payments don’t only generate late fees; they hurt your credit score as well. This is such a simple way to help your credit score that many people don’t do.

The second largest influence is the amount owed, which is equal to 30% of your score. Owing low amounts will give you a better score. Your credit accounts are usually reported at the same time every month. Sometimes you have a higher account balance than usual because of an unplanned and unavoidable situation. You can get the exact date that your lender reports your loan information to the credit reporting agency. Making an additional payment before this date can lower your reported credit usage, even if your actual usage is higher.

The third thing you can do is keep your average credit card history for as long as possible. Remember, each card you open causes your average credit card history to decrease. Open new credit accounts responsibly to preserve your credit. Some people think that the solution to the average credit card history problem is to open a bunch of credit cards at once. The thinking behind this is that if you open a bunch of cards within the same time period, it counts as one credit pull. While there may be some truth to it, you should always be responsible when opening credit. Each line of credit opened within the same 6 month period causes your score to drop. Subsequent lines cause your score to drop by 5 more points than the last line.

Different types of credit are handled differently. For example, credit cards are usually seen as short-term loans with low average values. A mortgage is a long-term, expensive loan. Lenders like to see variety in the loans you carry. For one, the more types of loans you carry, the more credit lines you will naturally have. Secondly, it shows lenders that you can manage a range of financial obligations. You should always be responsible when opening new credit lines. Make sure you can handle the monthly payments in your regular set of bills before signing anything, digitally or in person.

Know Your FICO Score and Find Ways To Make It Better

If you want to borrow any money or be granted any kind of credit, you’re going to use your FICO score. Your FICO credit score is a tool, nothing more. Most people avoiding addressing ways to help their credit score because they’re afraid of what could happen. Yet, if we consider each of the factors that affect our credit scores, we can find ways to make it better. We can pay our monthly credit bills on time, or lower our monthly credit card usage. Once we find ways to use our credit responsibly, our FICO credit scores will improve.