Debt Settlement: Its Impact On Your Credit Score and Overall Financial Situation

Updated: September 11, 2022

If you owe a large debt, debt relief programs sound like a lifesaver. There are countless reasons that people may have gone into debt. Once they are caught in it, the struggle to keep your head above water is difficult, and many people find themselves sinking deeper.

Table of Contents

What Is Debt Settlement?

Debt settlement (another term for debt relief) allows the customer to repay money owed while granting certain protections. During debt settlement, a creditor must agree to receive a partial amount of the debt, and treat the debt as fully paid. Once the agreement is in place, creditors are prohibited from attempting to collect more money on the debt. They also cannot sue you if you are holding up to your end of the agreement. This type of agreement sounds like a great deal for someone who is struggling with debt.

If debt relief is so great, then why are we concerned? The consequences on credit scores are often not fully understood by the customers most likely to use it. Debt settlement can negatively impact your credit. If you are considering this method to resolve your debt, we strongly recommend getting full disclosure.

How Debt Settlement Works

Debt relief processes are usually a last resort. After a customer has one too many missed payments of unsecured debt (like credit card debt), it goes to collections. The creditor believes that they aren’t going to collect the full amount, and is more willing to accept partial payment. The debt settlement company haggles with creditors to reduce what is owed.

This is usually reserved for unsecured debt. Secured debt, like a mortgage or auto loan, is handled by taking ownership of the security (the property). Federal student loans are also handled differently.

Debt relief is only successful when you stop making payments on your debt. It’s best if you take the monthly payment and put it in a bank account. After it accumulates a certain amount, the debt settlement company will negotiate with the creditor to accept this lower offer.

Debt Settlement Credit Score Impact

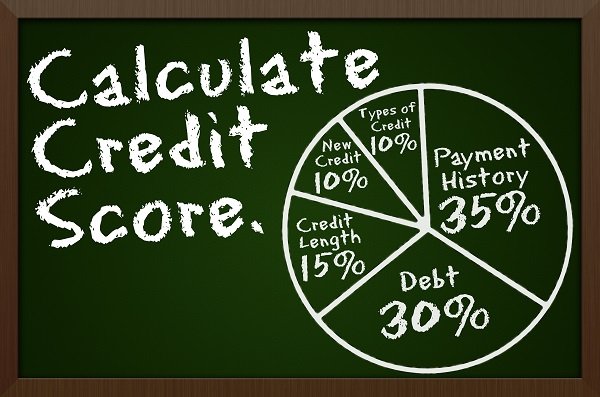

Unfortunately, the true impact of debt relief on your credit score is not usually discussed until it is too late. Recall that, in order to do debt relief correctly, you have to stop paying your credit account bill. Your payment history is the largest factor in your credit score, with a weight of 35%. Every month the creditors don’t get their money, they report your missed payment to the credit bureaus. The bureaus then process this information. The result is your credit score deteriorates. This negative information can stay on your credit history for up to seven years. Unless you take action to negate this, it will affect other aspects of your life. Your ability to get new credit, a new job, or a better car insurance rate may all suffer.

Although your debt settlement company and your creditor successfully reached an agreement, the debt still lives on your credit report. Your account is then reported with a “Settled” designation, which may give lenders pause for concern.

Other Dangers of Debt Relief

When you choose debt relief, you aren’t only putting your credit score in danger. Other aspects of your financial health can be devastated as well.

- Interest and other penalties are still applicable. When you stop paying your bills, and the following negotiation period, your interest and penalties don’t take a holiday. They keep accruing until the negotiations are complete.

- Negotiations can take years. The process takes an average of 3-4 years. Your credit score is still being affected in the meanwhile.

- Interest rates will skyrocket. As your credit score tanks, you look like a riskier customer. Lenders will apply interest rates to your new accounts to reflect this risk.

- Your taxes will rise. The difference between what you paid and what you owed is counted as income by the IRS. This is despite the fact that you never even held the money.

- The math is obscure. Debts are usually settled for 45-50% of the current balance, not the original balance. Then a 20% settlement fee and your marginal tax rate may be added to your costs. By the time the debt is repaid, you may have almost repaid the original amount in the first place.

- Bankruptcy as an alternative is avoided, downplayed, or introduced as a bad idea. Some debt relief companies describe Chapter 7 bankruptcy as an evil that will steal what little you have left after debt. They also claim that debt relief is easier on your credit score. In truth, most Chapter 7 filers are able to eliminate debt in six months and keep most of their assets. While both processes typically drag your score to the 500 point range, you can begin credit repair faster with bankruptcy. With debt settlement, you’ll be waiting for years.

- There is no guarantee of success. Your creditors do not have to accept the debt settlement offer. Even so, the Center for Responsible Lending suggests that customers only receive a positive benefit settling 4 or more accounts.

- It cures the symptoms, not the illness. If you don’t address why you ended up in debt, you can find yourself back in it soon enough.

Alternatives to Settling Your Debt

With a little effort, you can find a few alternatives to the debt relief programs. Not every program is a better choice. The key is understanding that your chosen solution will take time. You didn’t get into this much debt in a day, and you won’t get out that quickly either.

Better Alternatives Include

- Making a plan to be debt-free and sticking to it. There are many different ways to pay off your debt. For example, eliminate the highest interest debt first, or work from the smallest debt to largest (the snowball method). Making a plan uses strong commitment and the same general principals, no matter what method you choose. First, be honest with yourself about your financial situation, and your ability to pay off debt. You can use our free credit card calculators to help you visualize your situation and payoff plan. They can show you how long it would take you to pay off your debt, and how much your debt actually costs. You shouldn’t make the plan so strict that you end up resenting the process. In the process, you may realize that part of the solution is that you need more income. Look for opportunities to make cash available, which can be used to pay off debt.

- Negotiate with creditors. Some credit card companies have a program where their borrowers can get relief during hard times. Even if this is not the case, you can still contact your company and try to negotiate better credit terms. Simply asking for a reduction in your interest rate may be effective. In contacting your creditor directly, you save months or years of negotiations with a debt relief company. This will shield your credit score from harm.

- Chapter 7 bankruptcy. Some experts believe this is always preferable to debt settlement. This method results in a complete discharge of the debt if it cannot be paid back by using your possessions. While your credit will be hit hard, you can begin repairing it immediately. A consultation with a lawyer specializing in bankruptcy is usually free. If you do choose to file bankruptcy, you may only have to pay a lawyer’s fees and filing fees.

If You Can, Try to Avoid the Options Below

- Credit Counselling. You pay monthly payments to the credit counseling company, who pays your creditors over a 3 to 5 year period. The credit counseling company imposes a strict budget on you, freeing up money to pay off debt.

There are a few problems with credit counseling. About half of the people that use this method eventually drop out before completion. Penalties and debt are not suspended during negotiations and add to your overall debt. Not all creditors can work with this process, and you’ll have to manage them separately. Creditors see you as a risk since credit counseling shows up on your credit report. Most lenders prefer to issue new credit a year after the payment term ends. By then, you’ve had a chance to rebuild your credit. - Debt consolidation. This involves taking multiple debt payments and rolling them all into one. You may be able to lower both your monthly interest rate and payments. On the other hand, you can easily slip into more debt if you aren’t careful with the money you save. It can cost you more than not consolidating, especially if your repayment period is longer. Anything used to secure your debt (for example, your home) is now at risk if you can’t make the payments. If your consolidation company works like a debt settlement company, it gets worse. They could be withholding payments from your creditors, and destroying your credit score while they negotiate.

When Debt Settlement Really Makes Sense

Despite all this, debt settlement may be the most appropriate solution if:

- your debt is so unmanageable that you can’t file Chapter 7 bankruptcy, and

- Chapter 13 bankruptcy is your only option, and

- you’ll have at least five years of payments before your loan is forgiven.

In this very specific case, debt relief may be used to settle your debt faster. Once this is completed, you can begin repairing your credit score sooner than with other options.

Your Next Move after Settling Your Debt

Once your debt is settled, you need to work on rebuilding your broken credit score. When you were negotiating your debt payments, your score took months and years of nasty hits. Now it’s time to restore it by using credit responsibly. Keep the magic utilization ratio of 30% in mind when using credit. You should aim to repay your credit accounts in full and on time every month. (At the very least, you should make minimum payments by the due date, but full repayment every month is preferred.) Establishing this pattern is crucial to regaining a good credit score and staying out of debt.

Make Responsible Credit Decisions

Don’t be drawn in by the promises. Debt settlement is rough on your credit score and holds a lot of hidden dangers. If you need help to get out of debt, please consider all the available alternatives before making a decision. Remember, there is only a narrow band where using debt relief might make sense. When you clear off all your balances, you need to repair your credit score. This can only be done through responsible credit decisions, and carefully evaluating and selecting a credit building financial strategy.