5 Factors Affecting Your Credit Score

Updated: June 11, 2022

Name one thing that affects your finances, your ability to rent an apartment, your car insurance, and your future job? If you said your credit score, you’d be right. Your credit score is critical if you want credit cards, a loan, or a mortgage. It is just as important in determining where you live and how much you pay to insure your car. It may also factor into if you get the job. We think it’s essential to know and understand what affects your credit score. There are 5 big credit score factors.

Table of Contents

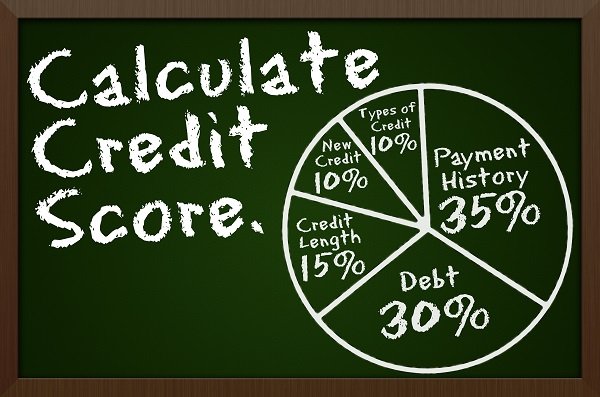

Factor 1: Payment History (35%)

Your payment history considers how you pay your bills and is worth 35% of your score. It looks at whether you pay your bills on time, and if you meet at least the minimum payment. Miss a payment, and this can affect your credit score by -100 points on average. Fortunately, the significance of the missed payment decreases with time. If you have negative information (a charge-off, bankruptcy, tax liens, collections, repossessions, or foreclosures), this can be bad news. It increases the difficulty of getting approved for credit. The best thing you can do for your payment history is to pay your bill on time and in full every billing period.

Factor 2: The Amount You Owe (30%)

The amount of credit you owe, as a percentage of your total available credit, impacts 30% of your credit score. This is your credit utilization ratio. It’s recommended that you keep this value to 30% or lower on each account. This will also result in your overall utilization at 30% or less. Because your utilization can be reduced by paying down debt, clearing off your balances will improve your credit score.

Factor 3: Your Credit History Age (15%)

This factor is worth 15% of your score. Credit history age looks at the mean age of your accounts and time that your oldest account has been open. The older your accounts, the more credit handling experience you show. Every time you open a new account, you shorten your average account age. Closing old accounts has the same effect. Both decrease your credit score, although opening a new account has a shorter temporary effect.

Factor 4: Mix of Credit Types (10%)

The type of credit you hold composes 10% of your score. Creditors want to see a diverse set of credit accounts between installment loans and revolving accounts. This factor is less significant for consumers with mature credit histories or credit reports with plenty of information. If you do decide to strengthen this factor, open new accounts responsibly.

Factor 5: New Credit (10%)

This accounts for 10% of your score. It looks at the number of hard inquiries you have on your report (this indicates that you’ve applied for credit). One or two inquiries over a short space of time aren’t bad. Several inquiries over the same period raise red flags with lenders and cost you points on your credit score. Too many new accounts may indicate you are a bigger credit risk due to a cash flow problem, for example. It may also signal that you are about to collect a lot of fresh debt.

Despite your credit report showing the last seven years of history, your inquiries have a much shorter shelf life. They only affect your score for 12 months and drop off your report after 24. Furthermore, multiple credit pulls within a 30 day period for companies in the same industry count as one inquiry. This means that you won’t be double penalized for comparison shopping for a mortgage or a car loan.

Things That DON’T Impact Your Credit Score

There are a number of factors that do not impact your credit score, especially if you are paying as agreed. They include:

- age

- bank balances and overdrafts

- checking your own credit (through a reputable, non-lender source or the credit bureaus)

- debit and prepaid cards

- employment status

- family financial obligations, including alimony and child support

- if you are part of a credit counseling program

- income or salary

- information not previously mentioned in your credit report

- insurance payments

- the interest rate on loans or credit cards

- marital status

- occupation, employment history, or employer

- race, ethnicity, national origin

- religion

- rent payments (unless you ask your landlord to report it)

- utility and cell phone payment (unless you ask your utility company to report it)

- where you live

- whether you receive public assistance.

Develop a Realistic Plan to Improve Your Credit Score

Now that you know what affects your credit score, you can make positive changes to your credit history. The first thing to do is to assess your current credit standing. To do this, request your credit history and score from AnnualCreditReport.com and the credit bureaus, respectively. Once that is done, you can begin developing a realistic plan to grow and maintain a good credit score.