The Truth About Building Wealth

The slogan of our website is REGULAR PEOPLE BUILDING WEALTH. So, what is wealth? Is a person driving a Ferrari on a highway wealthy? Is a Youtuber with a big stack of cash on their table wealthy? Well, they both may be and may not. It depends on how they are getting there.

Last Updated: April 25, 2023

You can follow along with the video by downloading this PDF document.

What Does It Mean to Be Wealthy?

For us, building wealth means concentrating on what makes us happy. Being wealthy means not worrying about time and money. It can be spending time with family and friends or racing cars.

So, being wealthy comes down to two things:

- We need enough money coming into our accounts – cash flow. This money should cover our necessities and monthly bills and provide more life options.

- Getting this cash flow should involve little or even no time. So, it needs to be passive.

Thus, building wealth means passive cash flow that you get without trading time for it, which allows you to have more options in life.

Let’s introduce a concept called asset here.

What is an Asset?

In economics, an asset is a resource controlled by the entity due to past events and from which future economic benefits are expected to flow. For example, if you work somewhere,, you are an asset as your employer makes money off your skills and time. Your education is an asset because the more you know, the more money you can make.

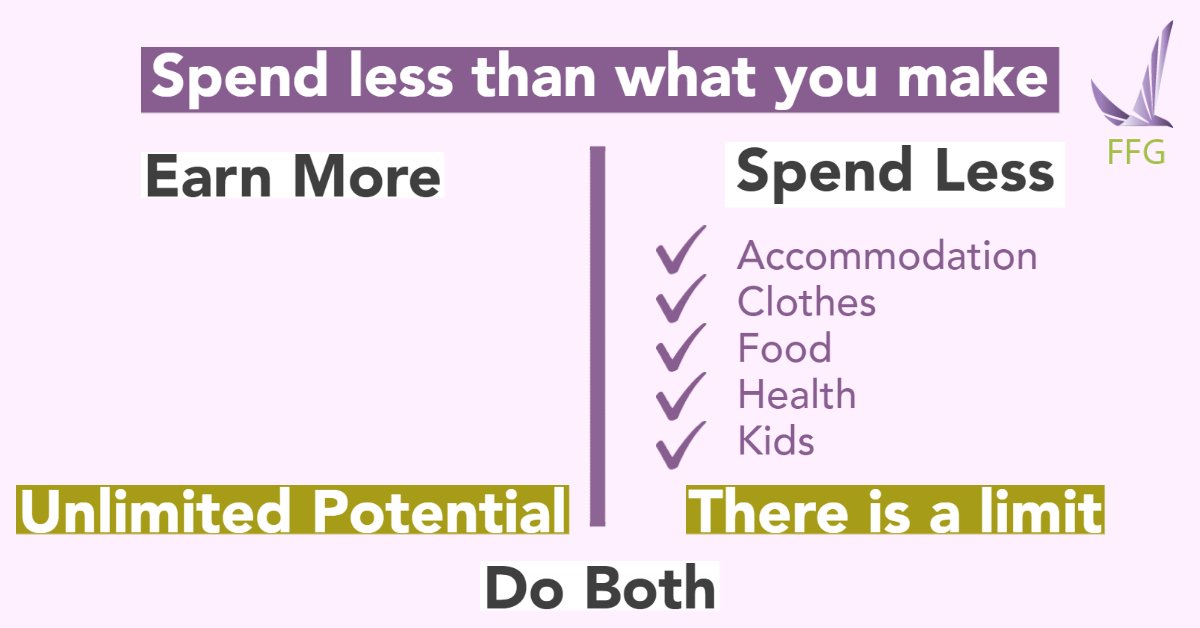

Spend Less than You Earn: the Key Rule of Building Wealth

Whether you have 2,000,000 or 2,000 dollars in your bank account, you should spend less than you make to become wealthy. It’s just common sense.

There are three ways to do it:

- Spend Less

Even if you are incredibly disciplined, great at budgeting, and don’t waste a single dollar, you still have to spend money on your home, food, insurance, kids, and other necessities to stay alive. So, there’s a limit on how much you can save.

- Earn More

Conversely, there’s no limit on how much you can earn. So, focusing mainly on achieving more and how you do it makes sense. Before addressing how to earn more, we should understand that time is our most valuable resource. Nobody knows how long they will live, and that’s why every moment is precious. It’s possible to earn back the money you lost, but it’s impossible to earn back the lost time, no matter how rich you are.

- Do Both.

How Can You Earn More?

Let’s take an example of an Amazon front-line worker who gets minimum wage per hour. The worker has several options to earn more money.

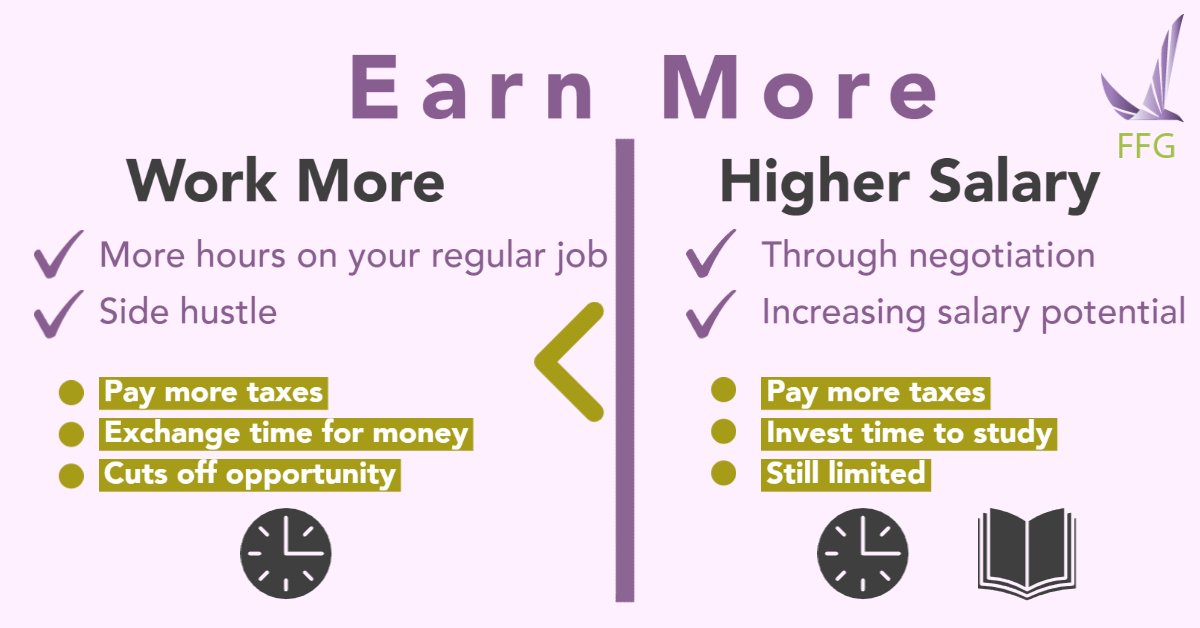

Option 1. Work More

The easiest way to make more money is to work more hours or moonlight (have a side hustle); for example, become an Uber driver.

It is a valid way, but very short-term. First, the worker’s salary increase will result in more taxes without control over it. So, the income won’t grow proportionally to the working hours and work intensity.

Like all of us, that front-line employee spends much time on the daily routines, such as eating, sleeping, and taking care of kids. Working 100% of the time is impossible. The main danger is that the more you work, the more time you exchange for money, and the less time you have, the less opportunity to create conditions for earning more you get (for example, by getting an education or starting a business).

Option 2. Have a Higher Salary

Let’s say that the Amazon worker is good at work and gets a job promotion and a higher salary through negotiation or by returning to school and gaining new knowledge.

It is better than the last option as the employee spends the same time but increases the cash flow. However, that person needs to trade time to get this improved knowledge in school or just while practicing. Again, the worker will have to pay more taxes with little control.

So, the Amazon front-line employee has higher earning potential, an asset. But that person must trade much time on this, and the earning potential is limited.

Once, Warren Buffett said, “If you don’t find a way to make money while you sleep, you will work until you die.” It is superior to both spending less and working more.

Although the two first options of earning more are valid, we should remember that we need passive cash flow for building wealth. Let’s look at our next options of earning more.

Option 3. Start a Business

Let’s turn to our example of the Amazon front-line worker. Let’s say that the employee has worked many years for Amazon and now has excellent knowledge of how the system works and what is needed to be successful on the platform. So, the worker decides to start their own FBA business.

Firstly, the newly minted businessperson has unlimited earning potential as they are in the driver’s seat now. For example, the former employee can optimize taxes if it is needed to fly to China to find a supplier, which will be a tax write-off. So, the businessperson can invest in their business (that is their asset) and get a tax benefit.

When the entrepreneur was an employee, there was no tax incentive to invest in an asset that was his/her knowledge because the more that person worked, the more he/she got taxed with no control over this.

Now we see a successful businessperson who can create a successful, scalable process that he/she can document and hire staff to do that for him/her.

Finally, the former Amazon worker can be physically absent from work and still make money.

However, to get to that point, no matter how genius you are, you must invest a lot of time and experience constant stress. Owning your own business is inherently risky. For example, the Amazon worker who started his/her own business may experience a change in Amazon’s algorithm. The supplier may screw up, and the entrepreneur may get sued.

Option 4. Invest

The only way to avoid this is to invest in assets that make money for us. For example, instead of putting money all back into the business, the businessperson in our example can start buying rental income properties that are managed by a great property management company. Without calculating the value of the homes, he/she can still get 12% cash flow each year. The former Amazon worker also may start buying dividend ETFs that give them a steady 5% per year.

Now with little-to-no involvement, the businessperson gets cash flow. The former Amazon worker has unlimited earning potential and can optimize taxes through registered accounts and business write-offs.

So, this is the best way to get money while you sleep. The biggest issue you may have is that you need resources to get to these assets. The central resource is cash. To invest $1,000 and get $50 each year is not enough. That’s why they say it takes money to make money. The rich get richer.

All this leads to the ultimate truth about building wealth: It doesn’t matter how high your salary is; to be truly wealthy, you should have assets that make money for you without time exchange.

Depending on where you start getting resources to acquire these assets, becoming wealthy may be very hard, not impossible, though, especially if you have a realistic plan, stick with it and stay disciplined.