How a Janitor, a Teacher, or a Librarian Can Become a Millionaire

How do you end up with a million dollars? You start with two million dollars. Jokes aside, most people think there are only three ways to become a millionaire. You must:

- be born rich

- earn a high income

- or marry into wealth.

Can librarians, janitors, or teachers become millionaires? Many people doubt it, but is it possible?

Nobody thought Genevieve Via Cava, a teacher from New Jersey, was serious. When Ms. Via Cava told her school’s overseer that she wanted to donate a million dollars, he laughed. He wasn’t smiling when a million dollars came from Genevieve’s estate. The money was meant to support education for students with special needs after high school.

People were equally stunned when Ronald Read provided $8 million to a local library and hospital. No one could fathom that the local gas station employee and manager had that money.

Four Simple Rules to Become a Millionaire

Many wealthy people have lost their fortunes over the years. For example, Mike Tyson earned $300 million during his career and owed $23 million when he filed for bankruptcy in 2003.

If your financial goal is to have at least a million dollars in the bank, you must do some work. It doesn’t matter how much money you have; what is essential is how you use it.

Use the rules below to start working toward your financial success.

Rule 1. Silent Millionaires: Fight the Urge to Compete with the Joneses

Who are the silent millionaires?

- Silent millionaires work regular jobs and live modest lifestyles, actively working to keep their expenses as low as possible.

- They aren’t tempted to own the biggest, best, or latest object money can buy. These millionaires will purchase cars secondhand and maintain them until it makes financial sense to buy another one.

- Silent millionaires clip the coupon for groceries and shop the sales. Their homes may be small and modest, but they are paid off.

- Silent millionaires know the value of saving.

Many experts recommend saving between 10% and 20% of our income, but quiet millionaires aim to save much more.

Remember Ronald Read, the gas station attendant from above? His friends said if Read earned $50, he would save $40.

Example: Janitor who became a millionaire

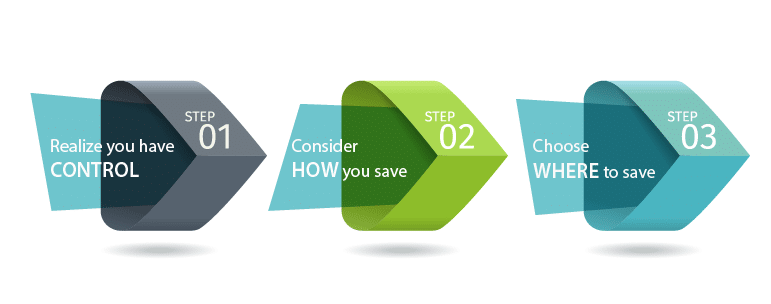

To become a millionaire, you should save at least 30% of your income, according to Cary Carbonaro, a certified financial advisor. According to Carbonaro, the rest of the work comes from compound interest.

Rule 2. Save and Invest as Soon as Possible

You could put 30% of your income in the bank. At 0.25% interest per year, you’d need $10,000 to make $25.

Silent millionaires know the best savings accounts and let them use compound interest to generate higher returns. They also play a long game, purchasing stock to hold on to it for decades. Any dividends earned are reinvested in their accounts, increasing their new principle for the next compounding period.

If you don’t have thousands to invest, consider individual stocks or an exchange-traded fund (ETF). Many of them allow you to start with a low initial investment, then add more over time.

Rule 3. Make Some Extra Money on the Side to Become a Millionaire

If you have the time and energy, consider taking on a side hustle. You may need to realize it, but someone will always pay for something. Look at some ideas:

- If you have a car, you can become an Uber or Lyft driver outside of work or advertise your vehicle on a ride-sharing app.

- An extra bedroom can be an occasional rental or a long-term subletting agreement.

- Use a skill or specialized knowledge to teach or become a consultant.

- Utilize social media to establish a following you can monetize through advertising income and affiliate marketing.

There is one thing we would caution, though. Many businesses go through a period of income loss in their startup phase. However, you should notice these losses decreasing closer to your break-even point. (This is the point where your business begins to make money.)

If you are facing significant financial losses, and your point of balance is distant, you may need to rethink your secondary business. You may have to change your financial plan or your business altogether.

Rule 4. Never Stop Learning about Your Finances

Silent millionaires don’t put their money aside and walk away. They know the money was earned through hard work and sacrifice. They proactively handle their finances by staying informed about financial news and investment subjects. Many of them communicate regularly with financially educated friends and advisors.

Sylvia Bloom, a law secretary from Brooklyn, would keep an eye on the stocks her superiors bought. She would follow up by buying the same stocks in more modest amounts. When Ms. Bloom passed on, her net worth was $8.2 million.

Silent millionaires aren’t extraordinary people. They’re ordinary people like you and me who do things just a little bit differently. They understand a few basic concepts that we take for granted:

- save as much as possible

- keep expenses to a minimum

- invest early and frequently

- keep learning about money.

Do you want to become a millionaire but need help to reach your goal?

Welcome to financialfreedom.guru! Look at our financial articles, calculators, and other tools that can guide you on wealth-building and gaining financial independence.

Let us help you generate your fortune.

Last Updated: August 15, 2023