What Are the Dangers With Balloon Payments?

Chrysler calls balloon payment loans “Customer Choice Financing.” That might sound great, but the truth is, it’s practically the worst way you can finance anything!

Today, we’re discussing the risks of balloon payments in two different but equally essential financing areas:

- Car loans

- Commercial mortgages

Table of Contents

Definition of Balloon Payments

Loans or mortgages with a balloon payment at the end may seem incredible because the monthly payments are generally lower. But at the end of the term, you face a hefty one-time payment.

That’s why they call it a “balloon” payment—the last payment is inflated compared to the payments before.

How Does It Work?

You may find a car loan or a commercial mortgage that offers balloon-type financing—but beware. Many countries have outlawed these financing arrangements, and we’ll discuss why in a bit.

Here’s a typical balloon payment scenario on a car purchase:

- You purchase a $40,000 vehicle and obtain a 5-year car loan at a 4.67% interest rate.

- Part of your loan agreement is a 25% balloon payment ($10,000).

- A balloon payment might look good on paper, as shown in the following graph.

| WITH BALLOON PAYMENT |

WITHOUT

BALLOON PAYMENT |

|

| Loan Amount | $40,000 | $40,000 |

| Loan Term | 5 years | 5 years |

| Interest Rate | 4.67% | 4.67% |

| Balloon Payment | $10,000 (25%) | n/a |

| Monthly Payment | $600.53 | $748.82 |

| Monthly Savings | $148.29 ** | n/a |

** This monthly savings could be added to a monthly family budget for groceries, another loan, utility bills, or for investing. But keep reading for why it generally doesn’t work that way.

Real World Financing Concerns

In the real world, people don’t save money with balloon-type financing in the real world. The monthly savings is too small compared to a huge payment due at the end of the loan term, and many consumers struggle to pay it.

Specific Risks With Balloon Financing

The biggest risk with this type of loan is you put off paying an inflated sum for a few years with no firm repayment plan.

Next, we’re discussing options with car loans. While this is an important subject, feel free to skip ahead to commercial mortgages if you want to learn more about that.

Comparing Balloon Payments to Car Lease Payments

According to Chrsyler’s website, balloon car financing beats lease payments because you own the car. Lease payments can be more expensive monthly, but we disagree that balloon payments are better.

Here are the issues you could have with balloon car financing:

Diminished Resale

Let’s say your car is involved in an accident. Your insurance may cover the damages, but because you own the vehicle, the accident remains on record while resale value is diminished.

When you lease a car, resale doesn’t matter. You simply return the vehicle to the dealership at the end of the lease.

Car Takeover

If you can’t afford to make your final balloon payment on a car, it’s doubtful that you’ll be able to sell it because few buyers want to assume that kind of payment.

If you’re leasing but you don’t want the vehicle anymore, it’s possible to find sites online where buyers will take over the lease for you. Search for “lease busters” or “lease takeover” for more information.

Looking at it that way, you’ll see why lease payments aren’t a bad thing. There’s also another danger with balloon payments that few car salespeople will tell you—upside-down car return.

Upside-Down Car Return

Being upside-down on a car loan means you owe more than the resale value of your car.

Unfortunately, this is a common occurrence with balloon payments, and when you can’t produce your final payment, here are your risks:

- Your car has already depreciated.

- If the car has been in an accident, it stays on the motor vehicle record, further diminishing resale value.

- If the car is now worth less than your final payment, you still have to pay what you owe.

- Sometimes, a car dealership will repossess your car, but you still owe more than its worth.

So how can you fix a bad situation with an unpaid balloon financing loan? You’ve got a few options.

Refinancing the Lump Sum

You may be able to refinance your loan. In real estate, it’s called a two-step mortgage, and for a car, you’re looking at a two-step loan. This refinancing means you pay more interest as you repay the loan and keep the car longer.

Seek Another Alternative Through the Dealership

Some dealerships will roll your outstanding loan into a new financing arrangement with higher monthly payments.

While this avoids repossession of the vehicle or lowering your credit score, it also gets you into a cycle of rolling debt that minimizes your chances to build personal wealth.

Let’s get to our second area, obtaining a mortgage on a commercial property.

Balloon Loans on Commercial Properties

Financing a commercial loan with a balloon structure carries the same risks, and it’s generally not a good idea. But there is one exception:

- You need a commercial mortgage for your new business. A balloon loan makes sense if you want to defer cash outflow for several years to build capital.

- Your monthly payments are lower during the initial payment term, and you don’t need to put assets up as collateral.

- With your business as your collateral, you can minimize your financial risks.

Final Word on Balloon Payments

Far from being a good “customer choice,” balloon financing is complex and is best for qualified borrowers with a stable financial plan.

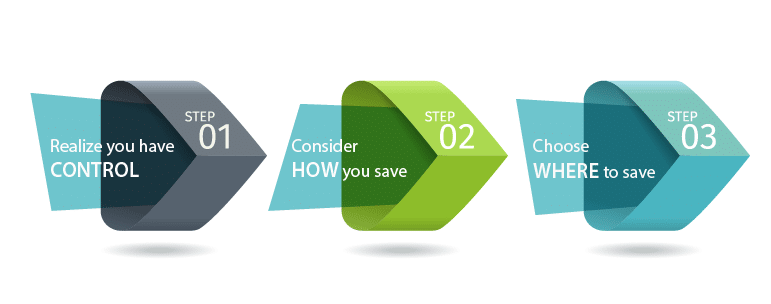

If you’re simply looking to purchase a home or a car, it’s better financially to have a monthly budget in place and assume a loan you’re guaranteed to pay based on your current income.

Some purchasers also save to make a bigger downpayment on a property or a vehicle, and this is an excellent choice because you’ll own more of an expensive asset with lower monthly payments as a result!