How to Invest 1,000 Dollars: Explore Your Options

What is the best way to invest $1,000?

If you’re in business for yourself, the answer might seem simple. Investing in the success of your business can deliver greater returns than simply playing the stock market—although business investing is equally risky.

That’s because investing in your business isn’t passive income earning like the stock market—succeeding in business requires tremendous sweat equity and constant planning to create opportunities and grow.

But what if you took an active approach to stock market investing? We’re going to examine how using the following strategies:

- Robo advisors

- Diversified ETFs

- Building a stock portfolio

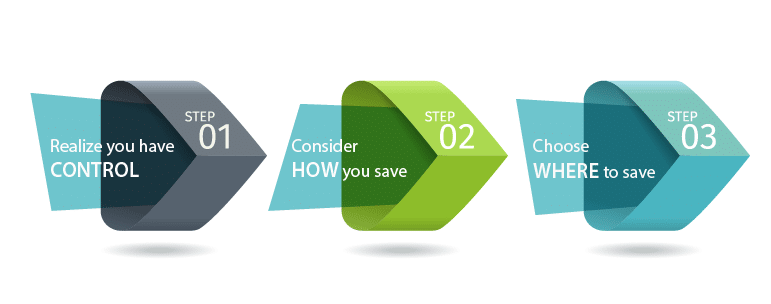

There are considerations to make before you invest that $1,000, such as:

Table of Contents

You Should Not Have Any High-Interest Debt

If there’s a downturn in the stock market, consider selling bigger-ticket items to pay down your debt load.

You’ll be better off financially by eliminating high-interest credit card balances, and putting more down on your mortgage during a market slump is an equally good idea.

You Must Have an Emergency Fund

The smartest thing to do financially is to have enough funds in a savings account to cover things like sudden unemployment. Try to keep three to six months of income in your savings as a cushion.

Your Investment Checklist

After paying off high-interest debts and having your emergency savings fund in place, you’re a step closer to investing that $1,000. You can evaluate your options with this checklist:

- Transaction costs

The market costs to trade can range from zero dollars to as high as $9.99 if you’re investing through traditional banks, and Canadian investors may also face rate conversion fees. Transaction costs can add up significantly over time.

2. Management expense ratio (MER)

An MER fee occurs with funds managed by an exchange-traded fund (ETF) or mutual fund company, and the amount you pay is a percentage of all your assets. So always look for lower fees to keep more of your money.

3. Diversification

A crucial step to proper investing is to shield your portfolio from bear market corrections when stock prices fall by 20% or more.

The best way is through diversification, but it will depend on your age and risk tolerance: while you benefit from investing in individual stocks, mutual funds, or ETFs at a younger age, be prepared to move it if there’s a financial crisis.

Beyond stocks and bonds, diversification means a wide range of investments at varying risk levels, including real estate, derivatives, cash value life insurance, annuities, and even resources like precious metals.

4. Rebalancing

The right investment strategy for you always depends on your age and current risk tolerance, and it may involve rebalancing your portfolio.

You can assign an active fund manager or even utilize computer algorithm software to rebalance your portfolio—if a computer interface is user-friendly, it may encourage you to save money or make automated contributions.

Now, let’s look closer at three promising strategies for investing that $1,000!

Robo-Advisors

This newer platform is becoming popular in the financial world.

Some investment companies use fully computerized robo-advisors for customer service, and others include a level of human interaction for investment management.

Robo-Advisor Advantages

The robo-advisor platform uses Nobel Prize-winning investment theory, and its advantages include:

- Account setup that’s quicker and more straightforward in assessing your current finances, goals, and risk tolerance.

- Available around the clock through apps or online.

- Minimizing emotion-led errors in investing.

- Lower fees compared to some human financial advisors.

- Tax harvesting is often automatic or a quick opt-in.

- More frequent portfolio rebalancing.

So, what is the biggest disadvantage of robo-advisors? At this moment in time, it’s that they aren’t human.

Automated, robo-advisor algorithms can only make recommendations based on quantified data like your age, planned retirement date, and approximate levels of conservative to aggressive risks.

Another Robo-Advisor Disadvantage

While robo-advisor fees can be lower, they aren’t consistent: fees range from 0.25% to 0.5% annually for fully automated robo-advisors.

Some companies charge more for a hybrid of robo-advisor and human fund manager.

Additionally, fund managers may claim a percentage fee (the MER we discussed under your investment checklist).

Diversified ETFs

Exchange-traded funds (ETFs) provide a simple entry for investors because they’re diversified and give reasonably good returns.

ETF Advantages

- Maximum exposure to many investment and asset types at minimal expense.

- Minimal guesswork is needed to match strong market performance over time.

- Easier (more liquid) to buy and sell ETFs than mutual funds online, often with just the click of a mouse.

For instance, putting $1,000 in an S&P 500 ETF means investing your money in 500 listed companies in an index—an easier fixed-income portion of your portfolio than more complicated individual bonds.

So are there any downsides to ETFs?

ETF Disadvantages

While investing in individual stocks can be more complicated than a diverse assortment of ETFs, the return potential can also be lower.

You’ll also pay a low-cost management fee with many ETFs, and if you bought individual stocks yourself, you wouldn’t have to pay fees.

Build Your Own Portfolio

When you take the time to learn to invest, it becomes a wealth-building strategy that you can grow with over time.

Here’s a good strategy you can use to build your portfolio, starting with $1,000:

- First, check out this graph for examples of stock performers (like Microsoft) in various sectors.

- Decide on 2-3 sectors:

- Follow your performers closely for movement in the opposite direction by learning the difference between a bull and bear market.

- For instance, stocks generally fall when investors get too bullish and rise when they get bearish.

- Choose lower-priced stocks to fit a $1,000 portfolio.

- Fractional shares aren’t recommended because they’re hard to move.

Continue building your portfolio by adding more sectors and minimizing risks by doubling down on others. Investing is challenging and rewarding, and the more you understand the markets, the greater your financial independence becomes.