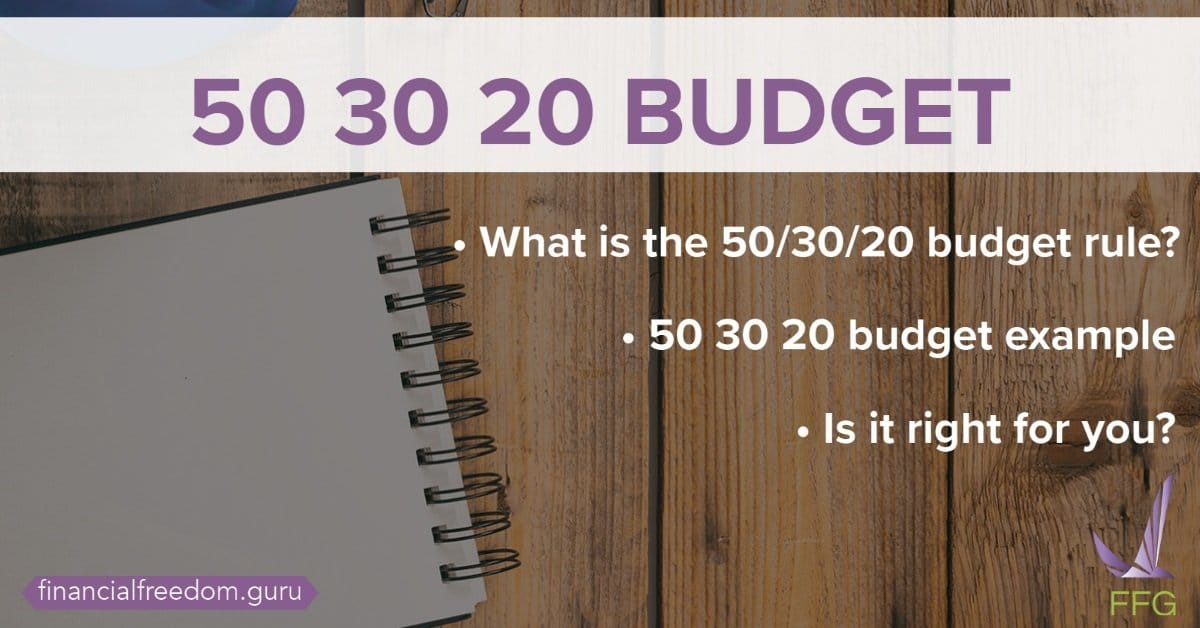

50 30 20 Budget

Updated: June 11, 2022

Did you ever stash coins away in a piggy bank as a kid? It was fun to save our allowance to buy a toy or go to the movies. But did you realize that you were learning to budget? Some adults don’t care about grown-up budgeting. They think it ties them down or forces them to be boring. Nothing is further from the truth!

Our topic today is the 50 30 20 budget, and it’s not just a fun game. Budgeting is a strong foundation for building personal wealth. Budgeting is a great habit to develop, and if today’s budget doesn’t work for you, there are other types of budgets to suit your goals and lifestyle. Let’s check out the 50 30 20 budget rule.

Table of Contents

What Is the 50 30 20 Budget Rule?

This budgeting technique separates your spending habits into three categories:

- Needs

- Wants

- Investments.

Senator Elizabeth Warren coined the term “50 30 20 rule” when she was a law professor at Harvard. Warren and her daughter, Amelia Warren Tyagi, discussed the 50 30 20 budget in their book called All Your Worth: The Ultimate Lifetime Money Plan. Warren wanted to show American working-class families how to budget. This type of budget works by dividing an income into percentages:

- 50% of income spent on needs

- 30% of income spent on wants

- 20% of income put into savings, investments, or paying more down on debts.

Let’s break down the 50 30 20 budget rule for each category.

50% of Income Spent on Needs

Sometimes people following the 50/30/20 rule get stuck on what “needs” mean. Think of it this way. Half of your take-home income (after tax) is for your absolute must-haves.

Here’s a 50 30 20 budget example list of what needs actually are:

- Housing

- Groceries

- Utilities

- Health insurance

- Transportation

- Minimum payments on a loan (not outstanding debts)

- Child care.

For the 50 30 20 rule to work best in your situation, you shouldn’t have to spend any more than half of your income to cover your essential needs or financial obligations.

If you’re frustrated right now because you are spending more than half of your income on your needs, have you ever considered making a few minor changes to save?

Here’s some data on what people in America are doing to save money on needs:

- Installing an energy-efficient thermostat to save up to 15% on utility costs.

- Downsizing a vehicle, carpooling, or public transportation saves thousands on insurance costs, maintenance, and gas per year.

30% of Income Spent on Wants

Nobody wants to give up their “wants,” and we all deserve to spend some money on a new outfit or a weekend getaway. It’s rewarding and good for our physical and mental health.

Here’s a 50 30 20 budget example list that defines what wants are:

- Equipment or materials for hobbies

- Dining out at romantic bistros or family steakhouses

- Vacations a few times a year

- Gym memberships

- Movie or concert tickets

- Subscriptions for magazines or streaming services

- Salon treatments.

If you’d find it hard to give up your wants, you’re not alone. Even though these items are considered optional, our wants should be what we allow ourselves to enjoy after working hard.

But your life is even better when you can enjoy yourself and still maintain your budget.

Here are some ways to enjoy what you want – affordably:

- A Google search of “secondhand sports stores” offers quality used merchandise for your sporting activities.

- Working out at home is more fun with virtual personal training through well-known sites like iFit, offering low-cost monthly memberships.

- Data on “cord-cutting” shows you can save over $1,000 a year by canceling a cable TV contract.

- Cooking at home saves thousands of dollars, and some websites offer step-by-step recipes showing how economical it is (like garlic butter chicken for $1.25 a serving).

- Even just making your coffee at home saves you almost $500 a year.

20% of Income Spent on Investments

It’s crucial to begin saving for retirement as early as you can. The 50 30 20 budget rule is one-fifth of your income towards savings and investments like IRA contributions and investing in conservative market-based ETFs (that’s our strongest suggestion).

Aside from the 50 30 20 rule, you should have three months’ worth of emergency savings in an interest-earning account – if you can, try to save even more than that in your emergency fund.

If this all sounds “undoable,” this retirement calculator will come in handy. Plugging in the numbers will help you work towards the goal of a comfortable retirement!

A 50 30 20 budget also allows for repaying debts over the minimum payments included in the needs category. What that means is, making extra payments on your debts to reduce principal and interest owed.

If you can’t save and repay under the 50 30 20 budget rule, here’s our guide to debt payments versus saving and investing and a calculator to assist you.

50 30 20 Budget Example

Let’s put the 50 30 20 budget into action. Here are a few notes:

- You can use the same 50/30/20 rule by simply plugging in your monthly after-tax income and 401(k) contributions.

- If your job pays bi-weekly, you will receive three paychecks in some months. Please consider that when doing this exercise.

- If you freelance, your income is monthly earning minus business expenses and amounts set aside to pay your taxes.

- Here’s how our 50 30 20 budget example works:

| Our example is: $3,000 monthly in after-tax income; $200 extra contributed to 401(k). | $3,200 |

|---|---|

| 50% Needs ($3,000 x .05) | $1600 |

| 30% Wants ($3,000 x .03) | $960 |

| 20% Investments ($3,000 x .02) | $640 |

- To make our example work for you, take your bank statement for last month and categorize what you spent in the three 50 30 20 budget areas: needs, wants, and savings.

- After figuring out what you spent in the needs, wants, and savings categories, try and adjust your spending to meet the 50 30 20 rule.

- The easiest way to adjust your spending is to focus on your wants category. Remember, under the 50 30 20 budget rule, a want helps you enjoy life. See if you can maintain your wants using the 50 30 20 budget recommendation of 30% of your monthly take-home pay.

- Trying to minimize your needs spending can be harder, especially in the housing, child care, and insurance areas. When you save more in the wants category, you can apply that money to your 20% savings category.

Is the 50 30 20 Rule Right for You?

A 50 30 20 budget works for some people. But your specific circumstances may make it harder to follow this budgeting method – so let’s help you in figuring out if it’s not right for you.

When the Rule May Not Work

- If it’s too hard to separate our needs and wants: an example of this is groceries. It’s categorized as a need, but some groceries (like snack foods or sugary drinks) are wants.

- It’s not your fault if 50% is too low to cover your needs. Depending on your monthly take-home income and where you live, the cost of living could be much higher.

- If your income is too low or too high, the 50 30 20 budget might not work. A minimum wage earner usually must dedicate more monthly income to needs. But a high-paid executive (annual salary of $1 million+) might not spend $40,000 a month on needs.

- If you want to retire early or buy a house, you will need to put more than 20% monthly into investments.

Conclusion

I hope we’ve helped you understand the 50 30 20 rule and whether it works for you! The purpose of budgeting tips is to help you become more financially independent. You could also try adjusting the 50 30 20 budget percentages to meet your personal needs and financial goals.

Or, you can try another budget method because there’s plenty out there (like the 80/20 rule or the 70/20/10 rule). There are even budgeting apps to ease you into budgeting and taking control of your finances.

Budgeting is a great habit to learn, and it’s essential in gaining financial independence. Now is the time to build your wealth for a sound financial future!