Maximize Savings to Build Wealth Effectively

Updated: June 19, 2020

One of the single, most important actions of building wealth is saving money. First, you must generate income; but it doesn’t matter how much you earn if you aren’t actively saving. You retain wealth when you regularly secure a portion of that income from spending.

If you want to build wealth fast, then you have to maximize savings. To do this, you will need to increase your savings rate. Your savings rate is the money allocated each year to meet long-term goals divided by your total disposable income. It’s usually quoted as a ratio or percentage.

For example:

Let’s say you manage to save $10,000 this year from a disposable income of $25,000. Your savings rate is $10,000 ÷ $25,000 = 0.4 or 40%.

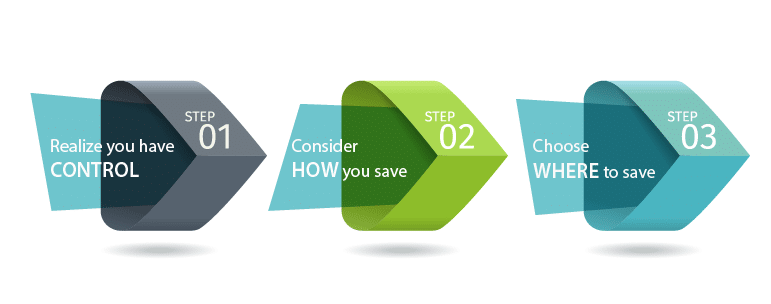

There are specific steps for how to save money that will accelerate the process. You may already know some of them, but just not had a chance to actually use them. Some of these ideas may be new to you. The main thing about these principles is that they have been found to work consistently.

Maximize Savings Rate: 6 Main Principles

1) Spend Less than You Earn

This is an example of a simple concept everyone knows, but few actively do. If your income is higher than your expenses, you’ll have money left over that can become savings. Many people have expenses that exceed their income, and cover the shortfall using credit cards or dipping into their savings.

If you’ve moved from needing loans to get by to having income = expenses, you should embrace the small win. However, do not forget that the goal is to have income exceed expenses. It’s best to sit and review your financial behavior. You should look at how and where you spend your earnings. This will help you create a budget that you are more likely to follow faithfully.

2) Save Money on the Biggest Expenses in Your Budget

It’s easy to eliminate the “extras.” You can make coffee at home, instead of indulging in your morning ritual at the local coffee shop. Shopping indulgences have been curbed in both frequency and financial expense.

Still, our biggest expenses are usually around things we need in our lives. This is where we tend to build a financial buffer. These essential spending items include your home, transportation, insurance, financial fees, and taxes. Sometimes, to be comfortable, we seek out more of these items than we really need. We may choose the bigger car over a smaller version without considering if we need the extra features. Insurance and banking products are rarely reviewed to see if we still need all that we’re paying for. Even if you have already made the purchase, take the time now to review how it fits into your situation. There may be opportunities to meet your financial obligations while simultaneously downsizing to fit your needs more appropriately. The resulting savings can be applied to your wealth maximization goals.

3) Build a Great Credit History

The truth is that bad credit is expensive. Lenders think you’re a high risk and charge you greater premiums for loans and credit cards. Poor credit can unnecessarily complicate your life in ways that a good credit score will not. Bad credit makes life expensive and complicated. Having good credit brings beneficial financial outcomes, like lower interest. A good credit score saves money and offers many financial perks that make life better.

4) Pay off Your Debt

Debt is an expense that eats away at your wealth. Going debt-free is one key way to maximize savings, save money and grow wealth.

If you currently have debt, it is essential to determine what should occur first: eliminate debt or build savings. You may want to consult a calculator that can show you the financial differences between paying off debt and saving money. Sometimes debt can be used as leverage, and other times, this is not as beneficial. When you see the numerical comparison, it may be easier to make a decision.

5) Save Early and More

When you start saving money from a young age, you tap into a resource that supercharges your efforts: time. This lets us use the time value of money (TVM): a dollar saved today is worth a dollar saved tomorrow. TVM benefits from using compound interest because we have more compounding periods when we have more time. Therefore, we save more because we had more time to generate interest upon interest.

It’s best if you can allocate more money towards saving. You should save small amounts too since every dollar saved increases your wealth. However, if you can budget extra money towards your savings without significantly diminishing your quality of life, then you should. This may require small sacrifices (less eating out in exchange for more home cooked meals, for example). It may also mean picking up an extra job or side hustle.

6) Understand Financial and Marketing Traps and Use Them to Your Benefit

There is always someone or something looking to separate you from your money. They come in different forms, and some are harder to identify than others.

- Marketers use instant gratification to convince you to purchase an item or experience immediately to feel better right now.

- Credit card marketing is targeted messaging to get you to apply for a card. The message obscures the cost of the credit card in terms of fees, spending limits and interest by pushing card benefits.

- Car marketing focuses on the features of the car, often wrapped in attractive low interest offers to entice customers. At the point of signing, the actual cost of the car is revealed. The dealer preys on your commitment to the car to push you to sign on the dotted line.

- Consumerism suggests that constantly purchasing and using consumer goods is the best practice. Materialism says that the tangible goods you own and physical comfort is most important. Both of them encourage you to keep buying more things.

- Lifestyle creep is the quiet change in your standard of living that occurs when your net income grows. It changes former luxuries into necessities.

Conclusion

Understanding and embracing these rules will help create a strategy where you maximize savings rate. This leads to a sustained habit of building wealth. Soon, you will find yourself realizing your goal of financial independence.

My saving lifehack – setting up a direct deposit for 5% of my paycheck to go into a savings account. It all happens automatically and I don’t miss it. I don’t have a card for the savings account and it is not at the same bank as my everyday spending accounts so it is easy to forget about it and not touch it.

Agreed, not even seeing that 5% makes it easier to save. Perhaps you can also automate the investing where you put this money into a safe ETF.

Agree with you that aving is a key factor in building wealth.I used to get my salary and pay my bills. And than spent it all. Now I first put money into my savings FIRST!!

I started doing this regularly and paid a $2800 car bill with cash. It felt so good.

It works for so many people, once you know there is no money in your account you are not looking for ways to spend the cash.

I set up additional bank accounts with automatic transfers for savings only. Not easy access helps me save as not my main accounts.

That’s a good tactic and forces you to save, good job!