Why Did My Credit Score Drop? Possible Reasons

Table of Contents

- Why Did My Credit Score Drop Suddenly?

- 1. Can Late Payments Affect Your Credit Score?

- 2. Do Large Purchases Hurt Your Credit?

- 3. How Closed Account Affects Credit Score

- 4. Will My Credit Score Drop If I Apply For a Loan?

- 5. How Much Does a Derogatory Mark Affect Credit?

- 6. Why Did My Credit Score Drop When I Paid Off a Loan?

- 7. Can Credit Score Drop For No Reason?

- Improve Your Financial Habits

Last Updated: July 30, 2022

You know that it’s important to have a good credit score, so you do all the right things. Any mistakes you make are short-lived: you’re always quick to correct them. Despite this, your credit score should be strong, and you have a pretty good estimate of where it should fall. Yet, when you look up your credit score, it’s much lower than expected.

If you find yourself asking “Why did my credit score drop?”, we’re here to help. Sometimes it is difficult to pinpoint exactly why your credit score went down. We’ll suggest several common reasons so that you can identify the issue, correct it, and restore your score.

Why Your Credit Score Dropped

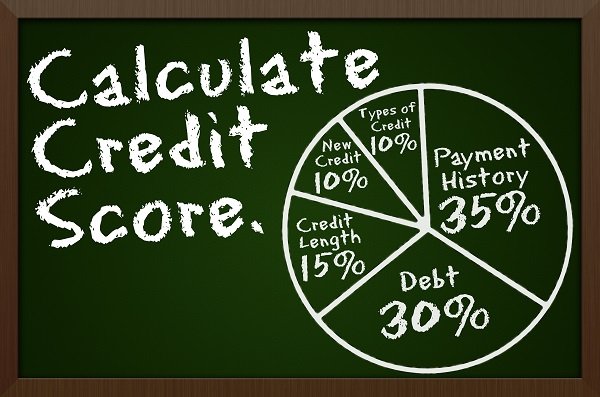

Your credit score is affected by five factors: payment history, new accounts, utilization, types of credit, and age of accounts. Perhaps your actions cause one of the five factors to be negatively affected, and now your score went down.

1. Missed or Late Payment

At 35% of your credit score, your payment history is the most important factor. The easiest way to ding your credit is to pay late or not pay at all. To correct this, make up the late or missed payment and set up reminders to pay your bill on time. You may also make weekly micropayments that cover your minimum payment. Ideally, the micropayments should cover the total cost of your credit card bill by the due date.

2. You Bought Something Expensive/Your Utilization Ratio Increased

Utilization counts for 30% of your credit score. Your utilization ratio is the amount of credit you’re using divide by your total available credit. Experts advise that your utilization should fall at 30% or less. Making an expensive purchase on your card increase utilization. Paying down the large balance will resolve the problem.

3. Closing an Account

You’ve decided to close that credit account you no longer use. This reduced your utilization, and age of your credit history (another factor, worth 15% of your credit score). The best defense is to keep old accounts open to protect your score from falling.

4. You Applied For New Credit

During the application process, the credit company will perform a hard pull on your credit. This negatively affects 10% of your credit score which is concerned with new accounts. You should only apply for credit when you both need it and can afford it. Aim for cards that you have a good chance of getting approval. Fortunately, the effect of credit inquiries (even hard ones) only lasts for a year. If you’re doing everything else right, your credit should recover in 12 months.

5. You Have a Derogatory Mark On Your Credit Report

It could be an account was sent to collections, or you missed paying a utility bill. Whether it was a bankruptcy, tax lien, foreclosure, or civil judgment, it all represents that you’ve defaulted on a balance. Protect your credit by monitoring your credit history frequently for derogatory marks.

6. You’ve Paid Off a Loan

You’ve been waiting for the day that you could make that final car, house, or student loan payment. No one told you it would come with a drop in your credit score. Paying off loans decreases the diversity of your credit mix (worth 10% of your score). A well-balanced credit mix is seen as a good thing by lenders. A credit history with one type of credit, or with many credit accounts either recently opened or closed is concerning. Lenders worry that you cannot manage your credit accounts. We’re not advocating that you hang on to the unnecessary debt. Instead, we suggest you should assess what your accounts will look like after you make the final payment. You should understand how this would affect your score.

7. There Are Mistakes On Your Credit Report

Sometimes the credit bureau makes an error, or your lender uploads the information wrong. Don’t pay for their mistakes. File a claim with the credit bureau who pulled the report with the error. You may also file a claim with the lender who reported the wrong information. Both parties are obligated to investigate non-frivolous claims and either correct or remove the error. If there are any accounts you don’t recognize, this may be a sign of identity theft. Make sure and file a police report, and a claim with the credit bureaus and the lender.

Improve Your Financial Habits

Most people are only informed that their credit score went down when they’re applying for credit. Unfortunately, that’s when they need it to be as good as possible. The best way to protect yourself is to go on the offensive. Work on improving your financial habits, and monitor your credit score and report regularly. That’s the most reliable way to avoid asking “Why did my credit score drop?”

Also the timing of the drop matters. There is the initial credit pull for pre-approval

The final pull before execution is usually a few days to a week before closing.

Could be a non issue

I agree. Many times just the fact you’ve had credit pulls for getting the mortgage you’ll see fluctuations.

I agree unless something fundamental has changed there is not likely a meaningful impact here.

Even if so, its such a competitive landscape. Some mortgage broker or online vendor will offer you the slightly lower rate.

I would know your score and shop rates and loan cost before any scores are pulled.

sure.Good plan A for sure. I’m just saying if there isn’t a real change as we mentioned above. And the mortgage company wants to dock you 1/8% I would walk on that. Find another vendor

Well yeah but that would be in pretty bad faith imo. They should account for that. I’ve bought 3 personal residences, 3 rentals, and multiple refis. That has never come up and I’ve used a few lenders over the years.

That’s why before you shop rates it is good to do you own credit report first

Not sure about anything else, but for me, they just care about the score when they first pull and got it! Down the road to closing, didn’t ask for more any inquiries

It all depends on your Financial Institution some do a soft pull in the end and some do a hard pull twice

I wonder if regular checking the score makes it lower?

If you are checking it yourself, for example from your banking app then it has no effect on your credit score. If you keep applying for new Credit Cards and the issuer does what’s called a hard pull, then yes your score goes down.

Thank you for the explanation

It’s a good practice to check once or twice a year in order to verify that their are no mistakes. But there’s no need to obsess about it.And as you are already explained, it is better to do it yourself

Credit scores can affect auto insurance rates, and employment opportunities. That’s why I do my best not to make it drop. A good article summarizing possible reasons of it. Thank you

Credit Score can effect your rental eligibility and rates as well

I check mine often. It’s a game to get it as high as I can. I know it’s pointless as I qualify for everything, but I like it.

Good way to keep yourself financially fit

I thought the same thing. It used to be that checking too often could negatively affect it because it shows up as a lot of inquiries into the score, or is that no longer true?

I believe that was something Obama did away with during the credit card act of 2009 but I’m having a hard time finding it. There may have been a more recent credit reform that it was part of but I definitely think it was part of last administration.

If you are checking yourself this doesn’t effect your score. If a lender does it, it will depend if it is a hard hit or not

I retired 2 months ago and noticed that my credit score dropped from 847 to 823. Nothing else has changed so any idea why?

Credit scores fluctuate every single month. For instance, your credit usage changes every month. A small change in credit usage can change your credit score. Of course, this is always temporary and has no memory as the following month, your credit usage will be different again.

Small fluctuations happen all the time

I have been told by lenders that scores are disproportionately lower and not reflective of an overall credit profile since the pandemic. I wonder if they’ve changed their algorithms (perhaps to slow lending?).

We know for sure that banks increased the credit score eligibility that is needed to get HELOC or mortgage, so this can be true as well.

I was doing great building back my credit it was at 600 just 3 months ago. I had two medical bills in collections hit, 2 late payments during COVID. And my score has dropped 40 points! I am absolutely desperate

If you made payments already you can try calling the medical companies to see if they would remove the late payment from your report.

I have been paying stuff off and mine drops every time I pay off a loan. I paid off an entire mortgage and my score dropped! You are not rewarded for payment because then the companies cannot make money off of you!

I heard once it was possible (at least in some cases) to ask a company to not close the loan account that is paid off. I’m gonna try it on one of my student loans!

This is just a temporary drop based on the utilization ratio – available credit vs how much you took out. When you close down the loan your available credit goes down, you can offset it by taking a home equity credit line on your home. That way you will have great utilization score and will have some liquidity from HELOC if you need to

I’m a user on my boss’s card and her larger balances regularly drop and increase my score (from 820 to 650 in the last six months and it will go back up in a month or two) Even though I carry no balances and she pays hers as well. I just wish she would pay hers twice a month instead of just once because it seems like it’s calculated at odd times. Also I’m gonna get off her card, because though the length of her credit history is helpful, the ups and downs are driving me nuts!

The monthly fluctuations don’t matter as much. As long as she makes payments you should be good,

That is frustrating, there are SO many factors that can affect a score going up or down…

At the end of the day the key is to make your payments on time and not to have too much debt compared to debt available to you.

I paid off my credit card last week. I was hopping that could help and my numbers would go up, but I’m so surprised that my score dropped 36 points.

This may be true for non credit card debt but your score will not go down if you pay off your credit cards as long as you don’t close them.

Two things: if you closed the account that can affect your total number of accounts and your length of credit. (More is -unfortunately-better). The other thing is if your credit usage changed too much by paying off the account – you need a good usage to allowed ratio. If it’s too low or too high, you are dinged points too.

As others have said if you closed your account you score might drop shortly due to utlization ratio.

In all honesty, your score doesn’t even matter to the banks. That’s just to qualify so they can run a report to get your profile and run it through their own model and see where you fall into risk factor. Nothing else.

It mattes to get into the door, if you score is bellow their requirements they most likely won’t even review your application as it save time. Depends on the financial institution though and your relationship with the banker.

I just started a new auto loan and it dropped my score by like twenty points. Credit Karma said that opening a new account decreased the average age of my lines of credit

That’s not a big deal, as it will bounce back in a few months and 20 points swing can happen throughout the month anyways

Hard credit inquiries can drop your score temporarily, try not to get more than 2 in 2 years.

Yeah usually it bounces back pretty quickly and depending on what you use them for, you can make up for the loss with the new credit and improved utilization ratio

I paid off my car!! A few months ago. I never missed a payment or was late. Finally my credit was headed up. Well the finance company closed the loan and I took a 58 point hit on my credit

it will go back up… I can’t recall exactly why that happens; I think it’s the adjustment of debt to income… some debt is good… with a good payment history… but it will go back up, no worries…

It was probably because your length of credit history was shortened. It will go back up in time.

That is a bummer! Mine took a nosedive when I paid off my mortgage. It took about 18 months to go back up. That is why I hate credit cards, etc. The whole credit concept seems to be designed to keep you in debt.

This is normal with the end of a loan but don’t let it discourage you from all the progress you made. It will bounce back!

Yeah, there is something seriously flawed in our credit system. As I pay off debt, companies lower my limit so I’m still using the same (sometimes even more) % of avail credit. Result=lower scores. Reason for denying better % on the cards. Arrrggghhh!

Congratulations on paying off your car loan, yes credit score drops temporarily due to decreased age of debt and less available credit. however not paying the interest anymore more than justifies it!

Been doing some reading on various sites and there seems to be some controversy about whether or not you should carry a small balance on your credit cards if you’re attempting to rebuild a bad credit score. Some sites say no, pay off the card every month but be sure to use it every month, keeping balance below 30%. Others say, keep balance below 30%, but only pay mimimim payment to show responsible use of credit and utilization.

What is best to boost a credit score that needs serious help?

Two dates to keep in mind: due date and statement date.

Use your card, make sure it’s below 30% of the limit (preferably 10% to maximize score) before the statement date. This is the date your balance reports to the bureaus.

Pay off remaining by the due date listed on the statement to avoid interest and late fees.

Repeat each month.