A Guide to Understanding Why Credit Score Matters

Your credit score influences a lot more than just what credit cards you’ll get. In this article, we’ll talk about why credit score matters. It can be used in background checks for jobs, in a rental application, and purchasing a car and car insurance. Unfortunately, if your credit is bad, it’s usually enough of a reason to deny you access to these things. Fortunately, you have us on your side. We want you to get the job, apartment, car, and car insurance for which you applied. We also want you to always pay as little as possible in credit card interest charges. We’ll discuss the actions you should take to make your credit score better.

Table of Contents

Getting the Baseline Reading

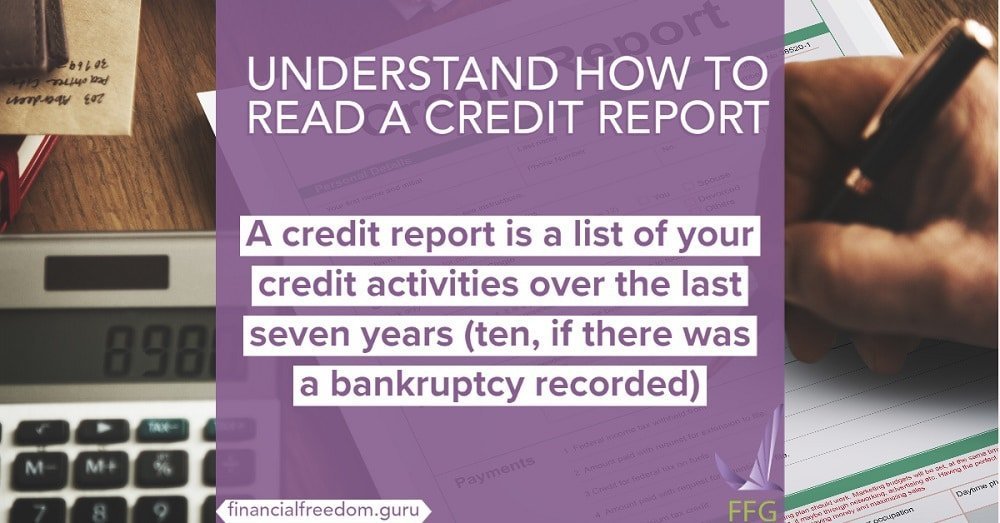

Before you do anything else, you should review your current credit history and credit scores. You’re legally allowed one free credit report every 12 months from each credit bureau (Equifax, TransUnion, and Experian). Under very specific circumstances, you may be allowed more than one copy. If you live in certain states, you can get a second copy free. Should you apply for credit or another loan and you were denied, you can also get a free copy of your report.

Log onto AnnualCreditReport.com to order your report. (This is the only place to order a truly free credit report.) Once you have your report(s), you should review it for errors or inaccuracies. This may be true errors (your lender made a mistake) or they may indicate identity theft. If you see something strange, file a claim with the credit bureau or your lender. They must acknowledge your concern within 30 days, and investigate your report. If the claim is legitimate (for example due to a mistake or fraud), it must be removed.

You can contact the credit bureaus for your credit score as well. These may not be free. They will send you a Fair Isaac Corporation Score (FICO), which the lenders use to evaluate your creditworthiness. Some credit cards and banks offer credit scores to their cardholders, but you should verify which score. It may be a FICO score, or from another system. You can also get a free credit score from a third party company like CreditKarma.com, Credit.com, or CreditSesame.com. These companies use the VantageScore system, which is an informational score that is not used by lenders. Still, it provides a pretty good estimate of where you stand with different credit bureaus. If you’re planning to apply for new credit, you should check your score as early as six months before buying. This will give you time to review errors, and take corrective actions to bring up your score before you apply. The odds of you getting approved will increase.

Take Corrective Actions To Improve Your Credit Score

Once you’ve seen where you initially stand, you can perform tasks to raise your score. These actions may not show immediate results, but you may see the effects of some of them faster than others.

1. Stop missing payments (and if you haven’t, don’t start)

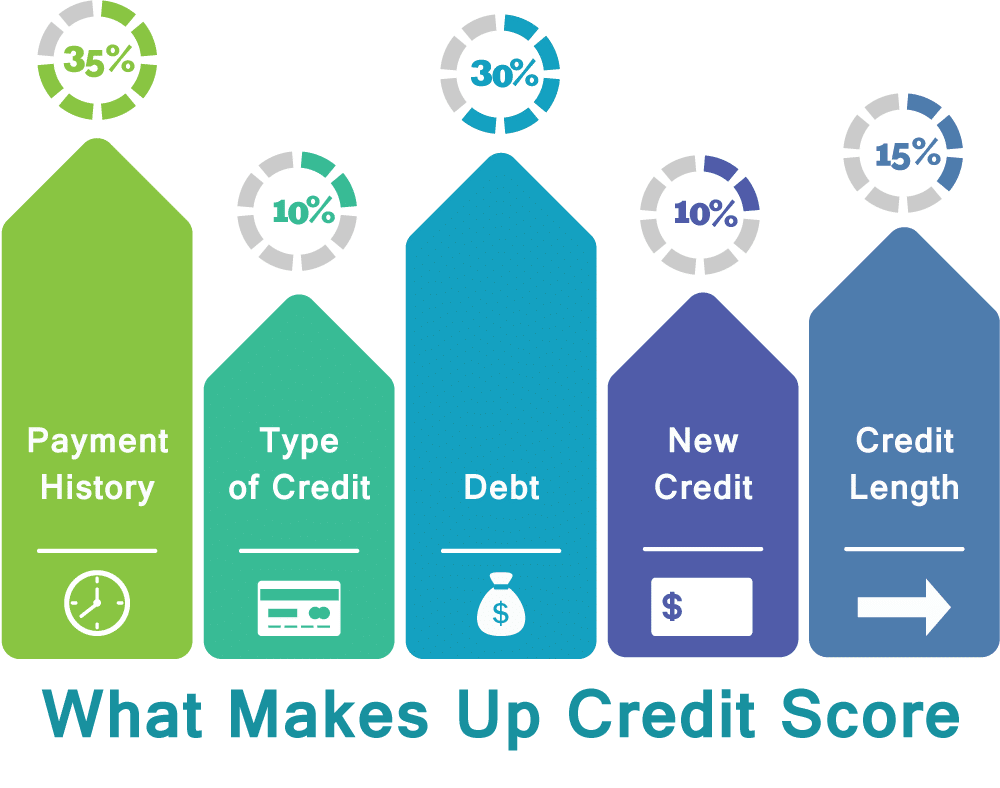

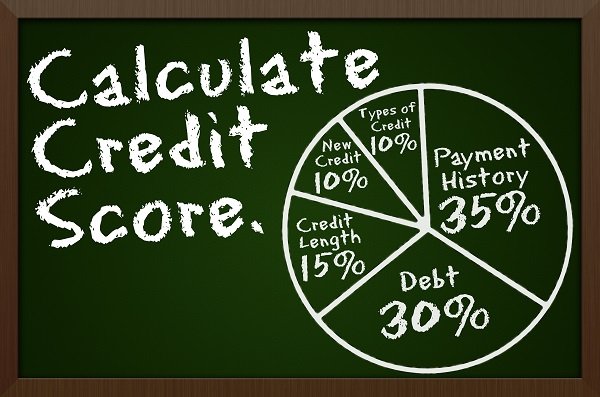

Your payment history is the largest single factor affecting your credit score. It is worth 35 percent. Establishing a pattern of meeting your payment obligations reassures lenders that you are less of a credit risk. If your monthly payments are too hard to manage at once, make micropayments during the month. To avoid missing the due date, set those micropayments on autopay. Don’t forget to give yourself a little buffer room just in case your due date falls on a weekend or holiday.

2. Establish different types of credit

The types of credit you own are worth 10% of your score. Lenders want to know that you can manage more than just credit cards. They want to see you can meet the obligations of an installment loan, like an auto loan or mortgage. Another option for diversification is a retail credit card.

3. Keep your utilization (ratio) low

Your utilization ratio is the amount of credit currently owed compared to the total amount of credit you have available. It’s the second largest factor influencing your credit score, and it’s worth 30%. An easy way to stay out of debt is to keep utilization low. A simple way to do this is to not use plenty of credit, even if you have a lot of credit available. The common guideline is that your utilization should not exceed 30%. This holds for each card and your overall utilization. A better idea is to keep your utilization as low as possible. If you can manage debt equal to 5% of your utilization ratio, don’t let your debt exceed 5%. Your credit score and your bank accounts will reflect this wise decision.

There are additional tricks to keeping utilization low. You shouldn’t cancel or close any cards that you’re not using. Removing unused cards reduces your available credit, and increases your utilization. Making micropayments also decreases the credit balance owed, which reduces utilization. If you have a good credit history with your lender, you can ask for a higher credit limit. Your credit utilization should always either trend downward if above 30% or stay level. Sudden spikes or increases in your utilization are a cause of concern for creditors.

4. Have a well-established credit history

Lenders like long credit histories, which make up 15% of your score. Teens and young adults can benefit from being added as an authorized user on a family member’s credit card. (Just remember that your credit activities have real effects on their credit history and score. Don’t abuse their generosity.) The length of your score is affected by opening and closing accounts. Don’t open too many accounts at the same time. You get double-dinged for shortening your average credit age and opening too many new accounts (another 10% of your score). On the other hand, closing older accounts because you don’t use them anymore can also reduce credit age.

5. Don’t apply for too much new credit

We know it sounds like we’re repeating ourselves, but this point is important enough to have its own explanation. Opening multiple new credit accounts means there are a lot of new hard inquiries on your credit report. Each of these inquiries can drop your score about 50 points. Lenders also get worried when you’ve gotten a lot of new credit over a short space of time. They’re not sure you’ll be able to keep up with the monthly payments.

6. Consider applying for a secured card

A secured card is an option to shift the credit risk from the creditor to the customer. You’ll put down a deposit of up to 110%, which secures the card. The money is held in a bank account while the secured card is open. Your lender then reports your credit behavior to the credit bureaus, which builds upon your credit history. If at any time you miss a payment, your deposit pays your bill. After a number of consecutive billing periods of good behavior, your creditor will convert your card to an unsecured one. Any remaining funds from the deposit will be released back to you.

Ask your creditors to which bureaus they report your scores. They aren’t required to send your score to every bureau. A bureau’s credit report will only list what information they have received. To maximize the results of this action, you’ll want a card with a lender who reports to all three bureaus.

Enjoy the Benefits Of a Good Credit Score

Your credit score takes time to improve, but the benefit of a better score is definitely worth the effort. A person with a very poor score can pay as much as three times in interest than a person with an excellent score. Whether it’s a credit card or an installation loan like a mortgage, a three-time increase is a significant financial hit. It means paying hundreds to tens of thousands of dollars in extra interest. By establishing your baseline, and using the corrective actions, you’re ensuring that you spend less money paying to borrow money. The money you saved can be used to build your emergency fund or build your short-term or long-term accounts. Regardless of what you do with it, the savings buy you peace of mind. This is why your credit score matters.

Are late payments and hospital bills killing my credit?

Yes, both late payments and unpaid hospital bills can kill your credit. The most significant factor influencing your credit history is your payment history (worth 35% of your score). Late payments appear on your credit report and can stay there for up to 7 years. This will lower your credit score. To learn how to remove late payments from a credit report, read this article. Your medical history is not included in your credit report. However, past-due medical bills are sent to collections, appear on your report and stay there for 7 years. Like any other collection account, medical collections… Read more »

They will most likely have a negative effect if they report it to the credit agency. Try to make at least a minimum payment on time and to talk to the hospital to see if you can get a better payment plan. Perhaps longer, but something that you can afford.