Know How to Pay off Debt to Improve Credit Score

Table of Contents

Updated: July 13, 2022

One of the most significant factors of any financial situation is debt. Debt can be broken down into whether you have it; how much you have; and what kind you’re carrying. Each of these influences your credit score in different ways. Understanding how debt affects your credit score can guide your actions to simultaneously improve your score and eliminate debt. Most people assume they should pay off debt as soon as possible to improve their credit score. Unfortunately, they sometimes discover that this wasn’t the best thing to do.

How Debt Influences Your Credit Score

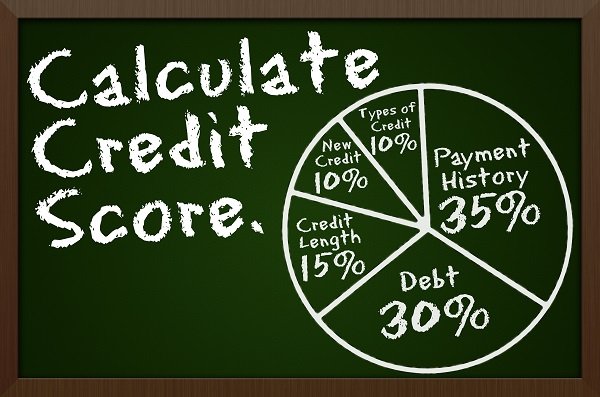

The five factors influencing your credit score are payment history, credit utilization ratio, credit types, new credit, and credit age. Debt affects two of the five factors: credit utilization and the types of credit you hold. Combined, these aspects control 40% of your credit score.

Credit utilization accounts for 30%. Your utilization is calculated as a percentage and generated per credit account, and across all your credit accounts. Credit utilization is the ratio of the amount of credit used (your debt) to the total available credit you have. For example, a $400 balance on an account with a $1000 limit has utilization of $400 ÷$1000, or 40%. Now, imagine that you have two cards, and the second one has a $200 balance and $2000 limit. Your overall utilization would be ($200+$400) ÷ ($1000+$2000), which equals 20%.

If you carry a lot of debt in general, it can diminish your ability to get new credit. Having plenty of debt on your credit account can affect your credit score, even if your debt-to-income ratio isn’t high. You can still be denied new credit.

The type of debt you carry is worth 10% of your score. Lenders want to see that you have experience managing different types of debt. These include credit card accounts, store cards, mortgages, auto loans, personal loans, and other installment loans. You don’t have to possess all of these, but having more than one type of debt will enhance your score.

Does Paying off Debts Always Improve Credit Score?

In general, paying off debt is a good thing. However, we also need to know how paying off debt can ruin your credit score. It is best to understand the factors that make up your credit score. The largest influence is your payment history, which is whether or not you pay your bills on time. This single factor is worth 35% of your overall score.

Your credit utilization ratio is the next largest factor. Remember that your credit debt is a direct input into the utilization calculation. The more debt you have, the larger your utilization will be, all other things equal. When it comes to utilization, most experts suggest that you keep your credit utilization to 30% or less. Anything higher than this makes lenders concerned. Maxing out your credit card, or going over your credit limit are red flags to credit issuers. In this case, it makes sense to pay down your debt to improve your score.

Ways to Pay off a Large Debt

Sometimes we need a little help if we’re struggling to pay off a large debt. With a little research, you may come across many different solutions. The most popular ones are debt settlement, debt consolidation, bankruptcy, and debt counseling services.

Bankruptcy discharges most debts and is resolved in six months. It gets a bad reputation because it wrecks credit scores and stays on your credit history for 10 years. Unlike debt counseling, you can start repairing your credit immediately after bankruptcy.

Debt counseling services sound responsible. You make monthly payments to a counseling company for up to 5 years, and they pay your creditors. Yet, they have a number of disadvantages. The failure rate is almost 50% of customers. Not all creditors will participate. The negotiation process can take years, while you are still responsible for accumulating debt and penalties. Lenders will generally offer new credit only after the payments have been completed for a year. Your dismal credit score may affect future employment.

In selecting one of the options above, carefully and thoroughly review all the advantages and disadvantages before making a choice.

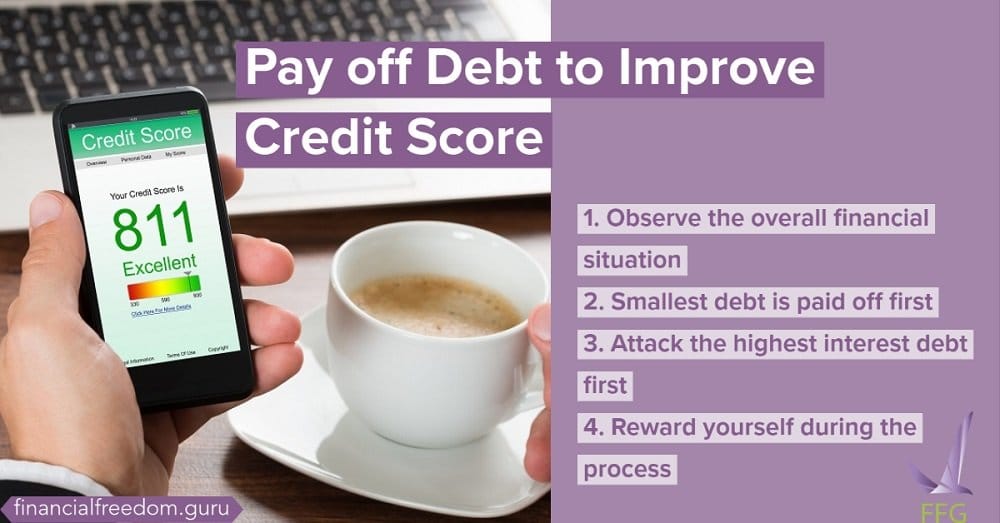

Pay off Your Debt Strategically to Improve Your Credit Score

If you decide to pay off the debt, and you’re not facing bankruptcy, you should use the following strategies. They work only if you have the time to work out some strategy to pay off your debt. The best part about them is that they do not lower your credit score.

- Observe the overall financial situation. Before you pay anything, you need to have a full comprehension of what you owe. Make note of all your income and expenditures, and analyze the data to observe any patterns. Create another itemized list for your monthly essentials costs, like utilities, car payments, insurances, cell phones and groceries, and minimum monthly payments. Subtract your essentials from your monthly income: the remainder should be used to pay off debt. If your essentials exceed your income, you can decide to increase your income or reduce your essential debt.

- Smallest debt is paid off first. It’s recommended that you pay down the smallest debt first (after covering the minimum on all your other debts). This strategy has both financial and psychological effects. Paying off the smaller debt frees up more money for larger debt later (the snowball effect). It also cuts down on the number of payments you need to make each month. Furthermore, completely paying off the smallest debt early in the process is strong motivation to keep the process going.

- Attack the highest interest debt first. The longer you take to pay down the highest interest debt, the more money you’ll owe in the process. If you keep eliminating the highest interest rates credit accounts, eventually you’ll only be left with the low ones. Do you have a habit of consistently paying your credit card bills on time? Call up your lender and remind them of this. You can leverage this good behavior to reduce your APR. The worst thing that can happen is if your lender says no, and you’re back to paying the original interest rate.

- Remember to reward yourself during the process. When you hit your milestones, you should celebrate your hard work. Without going back into debt, treat yourself to something nice. If you can, share your progress with someone you love. Friends and loved ones both support our actions and hold us accountable when we can do better.

Once the debt is paid off, you should aim to avoid falling back into debt. The only way to do so is to develop good financial habits that you will maintain with time.

Avoid Future Debt

When we pay off our debt to improve our credit score, we should determine if our actions are inadvertently harmful. Like any other financial actions, it is best if you take the time to carefully consider all of your options. The end goal should be to develop good, sustainable financial habits that will help you avoid future debt.