Remove Negative Items From Credit Report Wisely

Table of Contents

Updated: September 9, 2022

Negative information is never good. On your credit report, it’s even worse. Lenders see it as a legitimate reason to give you a credit card or loan with a higher interest rate. As a result, you’ll end up paying more for using their credit. When you remove negative items from credit report, you will have a better credit score. This is the main reason you’ll want to delete negative entries from your credit history.

Dispute Negative Credit Report Entries

The very first thing you have to do is review your credit report. Go to AnnualCreditReport.com to request a free official copy from each of the major credit bureaus: Equifax, Experian, and TransUnion. You can repeat this action once every 12 months. Pay attention to the section describing negative items like an outstanding utility bill or credit card debt.

You’re looking for any errors in the credit reporting. You may find an account that isn’t yours, or there may be errors in your personal information. Your credit account may still list items that should have dropped off or a paid account shown as unpaid.

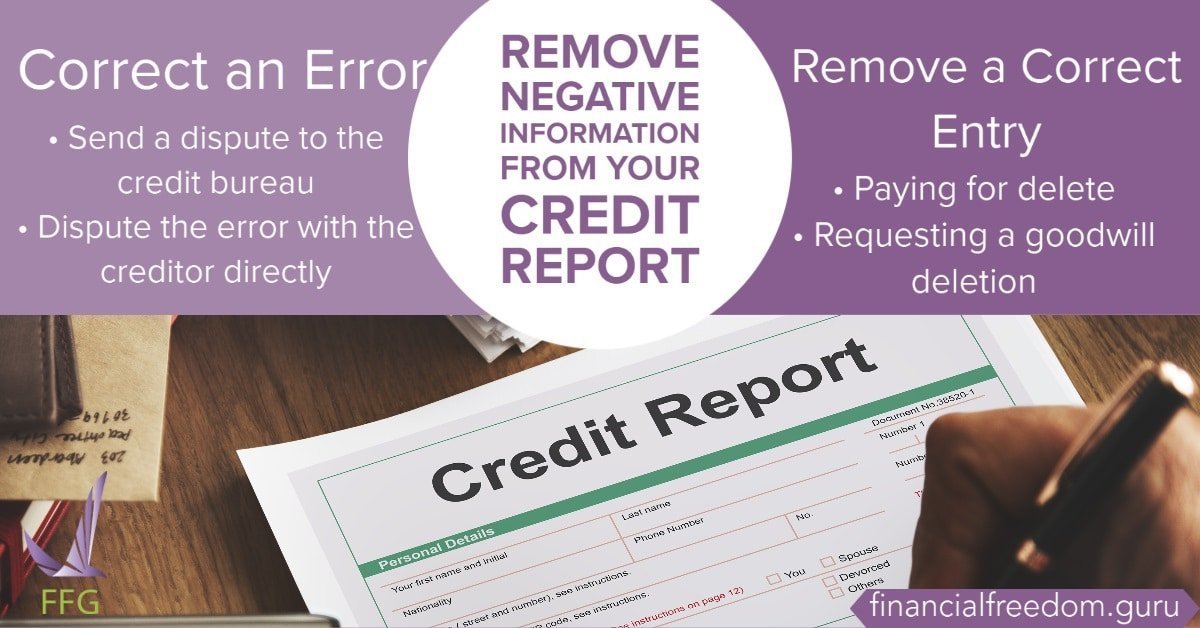

2 Ways to Correct an Error

Should you spot an error, you can correct it in one of two ways:

- Send a dispute to the credit bureau. The bureaus have made disputing credit report errors relatively easy. Experian allows the customer to launch the dispute online using your personal report number. (If you don’t have this information, they can provide a free copy during the process.) The credit bureau contacts the creditor as part of their investigation. If your complaint is verified as correct, the bureau will remove the error from your report. The process can take up to a few months. Check your report at a later date to be sure the mistake was removed.

- Dispute the error with the creditor directly. You can use a sample letter from the Federal Trade Commission, or capture all the relevant information on your own. Make sure to send the lender copies of all your supporting documents via certified mail. (Please do not send the originals.) Your creditor is obligated to investigate the mistake within 30 days. If an error was made, they must notify all three credit bureaus to correct your report. You should also request that they send updates to all organizations that requested your report over the last six months. If the creditor disagrees with your dispute, you may ask that a notification of dispute is added to future reports.

Can You Remove a Correct Entry?

In general, a credit bureau will not remove accurate information even after a dispute. You can try asking them to remove a correct entry by:

- Paying for delete. This is best for past due or delinquent accounts, where you can use a future payment as a negotiation tool. With this method, you offer to pay the full amount due on the account. In return, you ask the creditor to remove negative items from a credit report. This works for some creditors, but others may not accept your offer.

- Requesting a goodwill deletion. If you’ve already paid off the account, you’ve lost the opportunity to bargain with money. Instead of negotiating, you may be able to ask for a goodwill deletion by writing a letter. Find out who is the most powerful person within the creditor’s organization to grant a deletion and contact them. Let the creditor know why you made a mistake. Remind them of your good customer behaviors, and ask that your account be reported in a more favorable light. If there is a specific action you would like to occur, request it nicely. Remember, your creditor is not obligated to comply with your request.

What If Neither of These Options Works?

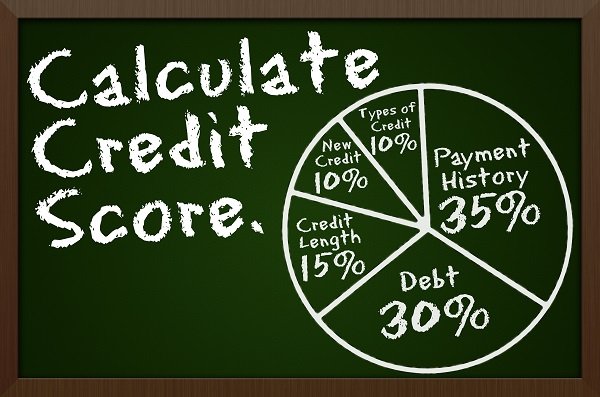

Well then, my friend, you’re out of luck. All you can do is to wait for the negative item to expire. At this point, it will drop from your credit report and your score will improve. While you’re waiting for this to happen, you can give your score an additional boost by adopting better credit habits. Good habits have the ability to positively affect all five factors of your credit score by improving your credit history.

Develop Good Credit Habits

It’s advised that you remove negative information from your credit report because it will help your financial situation. Having a better credit score means that lenders will give you some of the best terms for credit. After you delete the negative credit entries, you must develop better credit habits to keep your credit history robust. This will shield you against the need to remove negative items from your credit report in the future.