4 Ways to Remove Collections from Credit Report

Table of Contents

Updated: June 15, 2022

Debt collections are a result of having unpaid debts for several months. Your creditor will pass your account onto a debt collector and part of their job is to show this debt on your credit report, which won’t be doing your credit score any favors. There are a number of possible ways to have these debt collections removed from your credit report. It is recommended that you try to remove them to improve your credit score.

How Long Collections Can Stay On Your Credit Report

These debt collections can stay on your credit report for up to seven years. This is a long time if you are planning on applying for a mortgage or car loan, etc. The best option is to try and have the collection removed from your report completely. If you have exhausted all possibilities and nothing has worked, remember the collection will affect your credit score less as the 7 years pass.

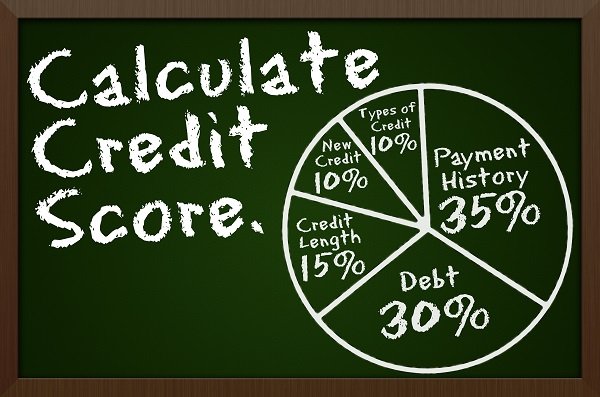

How Debt Collections Can Affect Your Credit Score

The better your credit score is before having a debt collection, the worse it will be hit when the collection shows on your credit report. Your credit score can drop anywhere from 50 to 100 points depending. As the 7 year time period goes by, your credit score will be affected less and less. Before any of this happens, there is a chance you can prevent your account from being sent to collections. Your creditor should send you a final notice of your debt before passing it to the collectors. At this time, you should offer to make a payment arrangement to prevent your credit score from receiving any drastic hit.

4 Ways to Remove Collections from Credit Report

-

A Collection is an Error

If the debt collection is an error, be sure to dispute it. You are not obliged to pay the debt and the debt collectors won’t list it on your credit report. Take a look at our article “Disputing Credit Report Errors.”

-

A Goodwill Deletion

Perhaps a long shot, but it is always possible that the debt collectors will remove the collection from your credit report in certain circumstances. If you write a goodwill deletion request and explain your situation around the time you fell into debt, perhaps you had a health issue or family bereavement. The collectors may show some compassion for your situation and agree to remove the collection from your credit report. These types of requests will only work with accounts that you have already paid previously.

-

Pay for Deletion

If disputing your debt in error isn’t an option, and a goodwill letter did not succeed either, then you can also consider having your debt removed in exchange for payment to the collector. The collector may not want to agree to this but if they do, ensure you receive a signed copy of your agreement before making any payment. For proof after payment, make sure you send all correspondence through certified mail and request a return receipt. Be sure to double check the collection has been removed after payment. If you notice it hasn’t, you should make a dispute promptly and provide a copy of your agreement with the collector as proof.

-

Settle the Debt

If all else fails, pay the debt. You are better to pay off the debt and show future lenders that you stepped up and were responsible in the situation. Once you pay off your debt, you just need to wait for the credit reporting time limit to end. Then the collection will be removed from your credit report.

Don’t Panic

Debt collections are not the end of the world, don’t panic. You will have a few possibilities to remove collections from your credit report. The main thing is you try all of the options suitable for you. If none of your attempts at having the debt collection removed work, then make sure you pay off the debt as soon as you can. If you can show that you were responsible for your financial situation, then you will look better to future lenders, even if the debt collection is still on your credit report.