The Largest 3 Credit Bureaus: How They Work

Table of Contents

Last Updated: November 29, 2022

Note: During the coronavirus outbreak, the 3 credit bureaus allow you to get credit reports for free once a week!

A credit bureau, also known as a credit reporting agency, stores, compiles, and evaluates your credit history. Credit bureaus hold information about your payment patterns, balances owed, and how you apply for, use, and maintain credit. When a company with a legitimate reason enquires about your credit, the credit bureau will sell them a report. Your credit score has a direct effect on the size and interest rate of the loan for which you qualify. Credit history may be used as part of a background check for jobs, or to assess a potential tenant. Insurance companies use it to determine whether you’ll be a high risk. Utility companies use it to determine if you’ll pay a deposit. With credit history affecting so many vital aspects of our lives, credit bureaus perform a crucial function.

To be clear, credit bureaus only analyze, package, and send credit information; they don’t decide if you’ll get a loan. Your lender does that.

What Are the Major 3 Credit Bureaus?

Although there are many credit reporting agencies, there are three main ones people usually talk about: Experian, TransUnion, and Equifax. These three are the largest agencies in the market, holding financial histories of more than 200 million U.S. customers. A brief synopsis of each of these companies is given below:

- Experian started as TRW Information Systems and Services Inc. in 1968. It currently has headquarters in Dublin, Ireland, Nottingham, UK, and Costa Mesa, California. It employs approximately 16,000 people and operates in 39 countries. Experian specializes in providing marketing pulls for businesses offering credit card pre-approvals.

- Equifax was founded in Atlanta, GA as The Retail Credit Company in 1899. Its headquarters are still there. There are about 7,000 employees globally. It focuses on the analysis of corporate credit.

- TransUnion began as the Union Tank Car Company in 1968. It’s currently headquartered in Chicago, IL, and has about 3,700 employees across 33 countries. It concentrates on American expatriates’ credit information analysis.

How These 3 Credit Bureaus Work

All credit bureaus collect the same general information about you. They use your personal identifiable information like your name, social security number, date of birth, and address. The record has your credit accounts, payment history, and the other organizations or persons who have requested your data. Credit bureaus pull material from public records, collections, bankruptcies, and tax liens for each consumer. They also collect trade lines, which are the key features of your loan. Tradeline information includes the loan type, date opened, account status, last activity date, amount past due, and comments. The resulting information is saved and extracted when your credit history is needed.

There are some things credit bureaus don’t care about. They do not collect any evidence on your gender, income, race, or ethnicity. Your political views are also of no concern.

How the Credit Bureaus Gather Information

A credit reporting agency can gather information in four ways. They can purchase it from public record databases (often used for things like bankruptcy judgments or government tax liens). Lenders (also called data furnishers) report your behaviors to the bureaus directly. Despite being competitors, credit bureaus share legally required knowledge with each other, like fraud alerts. Other sources (like your utilities, memberships, and your landlord) voluntarily report your payment history to credit bureaus.

Once the information is collected, it is stored as a credit file and held until requested.

Your information can be accessed with a “soft pull” or a “hard pull.” A soft pull doesn’t affect your credit score and is used more frequently during background checks. A hard pull is a voluntary action, in which you must give consent since it affects your credit score. This is the type of pull your credit card, mortgage, or auto loan issuer uses. The creditor receives your credit data in the form of a credit report. This is the most recent seven-year history of your credit activities. (It may include some activities, like bankruptcy, for up to 10 years.) You can get a free credit report every 12 months from the agencies listed above at AnnualCreditReport.com.

Why Do Reports Differ By Agency?

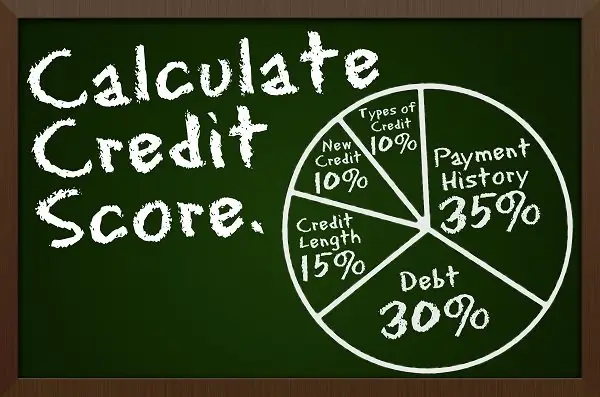

It depends on the information each agency receives about your behavior, and how they calculate your score. There is no requirement that all of your credit behavior or creditor inquiries be sent to each agency. A lender pulling your report may prefer to work with one or two companies instead of all 3 credit bureaus. Lenders do not have to report your loans and payment history to each credit bureau.

Even if the lender sends the information to all three companies, your report may have variations. Each credit bureau may have a different monthly data processing date. If they receive your lender’s feedback after they’ve processed data for the month, it gets reported in next month’s update. As each bureau modifies their scoring methodology to be more accurate, this adds extra dissimilarity between scores.

FICO Is Not a Credit Reporting Agency

Often, when we talk about credit, we talk about FICO scores. This has led many people to falsely believe that FICO is a credit reporting agency. It is not. The Fair Isaac Corporation (FICO) is responsible for creating and supporting the credit score system. It uses the data from the credit bureaus to generate a three-digit score between 300 and 850, inclusive. They do not collect or report data beyond this purpose.

Get Your Score From the 3 Credit Bureaus

Each of the 3 credit bureaus can give insight into your customer’s credit history. This information is necessary to make a reasonable judgment on the customer’s credit risk. You can review this information for yourself. To have the complete picture, you should really get your score from all 3 credit bureaus. This is to protect yourself just in case the credit information reported to one bureau differs from the others.