A Guide on How to Dispute Credit Report Errors and Win

Updated: August 3, 2022

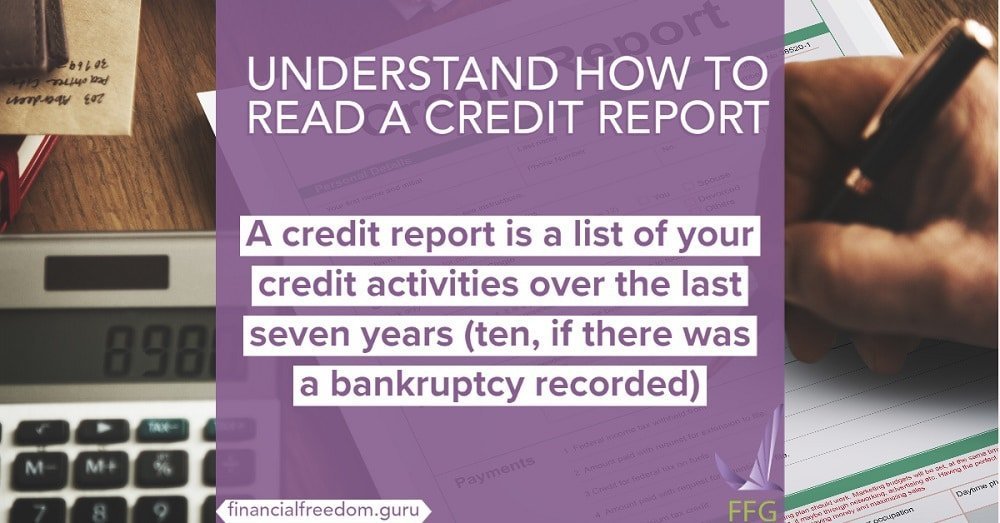

Credit report errors can cause further problems and delays when obtaining credit in the future. You may notice a small mistake on your report but don’t hesitate to have it corrected straight away. If you choose to ignore these mistakes you can run into bigger difficulties in the application process for a new credit card or more credit. These credit report errors can be as a result of an oversight you made in your application for example or they can be the lender’s fault.

Table of Contents

4 Types of Credit Report Errors

There are several different types of credit report errors, all are equally important to correct.

- Identity errors – Anything involving incorrect personal information can be crucial on your credit report, and mix up of accounts with the same name as yours is another problem.

- Account status – Sometimes a closed account can be reported as open. Your account can also be listed as having the wrong date of last payment/date opened etc., or having the same debt listed twice or more times.

- Data management – This can frustratingly include the wrong information being reinserted even after correction. Or where accounts show up several times with different creditors listed.

- Balance errors – Your account can perhaps show the wrong current balance and incorrect credit limit.

How Credit Report Errors Happen

Now that you know the different types of errors that can occur on your credit report, it’s important to understand how these errors come about in the first place. It is likely that you will receive a credit report with errors at some stage, and these are more than likely down to human error. Usually, it is a simple mistake made by you or your lender, which if it isn’t corrected can snowball and cause bigger complications. Be sure to ask for your free credit report each year from all three major credit bureaus, and look at it in detail to iron out any mistakes made on it. Follow this link to request your credit reports.

How to Dispute Errors on Credit Reports Step by Step and Win

First, and most important step to take is to make sure you thoroughly read all three of your credit reports. Don’t skip any part of the report, ensure you have noted any errors – big or small.

Secondly, you should gather all the relevant material you may be asked for to support your case and prove that whatever information on the report needs to be corrected.

Lastly, decide how you will make your dispute either online, by mail or by phone.

Disputing Credit Report Errors Online

This is probably the most simple and quick way to make your dispute, but sometimes there are drawbacks. You cannot fully complete your dispute online as you will still need to send proof to support your dispute through the mail. However, you can also easily check the status of your dispute online by simply providing your confirmation number. Although the final results of your dispute will only be sent to you by mail. Follow the below links to submit your online credit report dispute:

Disputing Credit Report Errors by Mail

When submitting your credit report via the mail, it is a given that it will take more time. When you make your dispute with the credit bureau, they then have 30 days to respond to you, or 45 days if you need to send additional paperwork during the 30 day period. In your written letter you need to make clear the information that is incorrect and if possible include a copy of proof. Keep track of when you posted the letter and send it through certified mail. Also be sure to request a return receipt so you know when the letter is received by the credit bureau.

You can send your written dispute to the following major credit bureaus:

Equifax dispute by mail address:

P.O. Box 740256

Atlanta, GA 30374

Experian dispute by mail address:

P.O. Box 4500

Allen, TX 75013

TransUnion LLC dispute by mail address:

Consumer Dispute Center

P.O. Box 2000

Chester, PA 19016

Disputing Credit Report Errors by Phone

If the previous options don’t appeal to you, you can always simply call the credit bureau and make your dispute over the phone. It might take time to get to speak to somebody, but it might be more reassuring to speak to a real person instead of online or by mail. Make sure to take note of when you called, who you were talking to and any useful information they gave you.

You can make contact with the major credit bureaus on the following numbers:

Equifax dispute phone number: 1-866-349-51-91

Experian dispute phone number: 1-888-397-37-42

TransUnion dispute phone number: 1-800-916-88-00

How Credit Bureaus Respond to Your Dispute

The credit bureau won’t respond to all disputes in the same way. Sometimes, they will delete the disputed information straight away. They can also reinsert the information if it is later verified to be correct. If any information is reinserted, it is their obligation to notify you via mail that the information is back on your credit report.

The credit bureau also sends notice of any inaccuracies on your credit report to the original information provider. These original providers then investigate the data they are given and must respond to the credit bureau. If changes were made to your credit report, you will be given a free copy of it, once all investigations are complete. Along with this, it is recommended that you request the credit bureau to send a free correction notice to any company that accessed your credit report in the last six months.

Also, take into account that any incorrect information on your credit report with one credit bureau will likely be incorrect on the other two bureaus’ reports, so make sure you check all three versions of your report to see that the information on all of them is correct.

Make Sure Your Disputes Are Legitimate

When you are sending your disputes, the most important thing to remember is to never send more than one dispute at once. You want to make sure the credit bureaus don’t think your disputes are frivolous. If you are going to dispute the same discrepancy more than once, make sure you give a different reason for each dispute, the bureau may see them as duplicates if they are for the same reason. The credit bureau has the right to reject your dispute if they see it as frivolous.

Be Attentive in the Future

It is extremely important to fix any errors you notice on your credit report, otherwise, you may run into problems when looking for credit in the future. Just make sure you approach the situation correctly and have the documentation to back up your dispute. Once you have any discrepancies removed from your credit report, don’t forget to keep an eye out for any errors in the future.

How to dispute credit report online and win?

To win a credit report dispute, you have to convince the credit bureaus that there is an error on your report. Gather all information that supports the case. File a dispute online and attach the necessary documents to prove the error. Good luck!