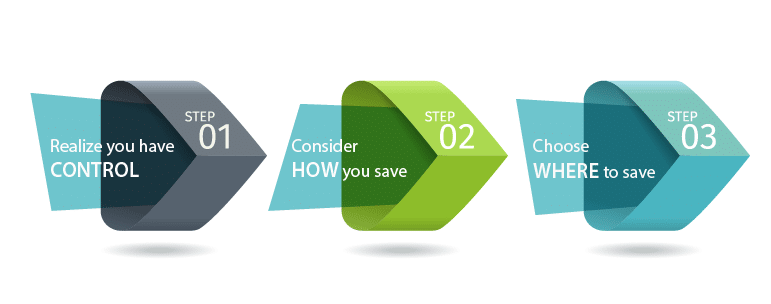

Three Simple Money-Saving Tips to Follow

Saving money is one of the necessary steps to building wealth and gaining financial independence. There are three simple money-saving tips you need to follow down the path of financial success.

Table of Contents

Tip 1: Realize that You Have Control

There are so many things begging for your financial attention. What you purchase is determined by your ability to show restraint. Ultimately, it’s you that decides what you buy and what you leave behind. If you’re not careful, your savings will become your new car or your next vacation. To avoid this, you need to budget. Budgeting is an effective way to start planning how to use your money. Besides, be sure to understand behavioral psychology and identify your biases. This will help you gain control over your finances.

Tip 2: Consider How You Save

Most people manage their money the same way. They have a checking account and a savings account. The checking account is for your day-to-day use. You use this money for items like clothing, groceries, commuting costs, insurance, and rent. After these are paid, whatever money is left over is usually then put into your savings account.

Strategic Savings Goals

Instead, we should view savings as one of three strategic goals, and put them into the following buckets.

- Emergency savings. This is easily accessible money that you can use in a real emergency. (Just to clarify, brunch with friends or buying the designer shoes on sale is not an emergency.) It’s recommended that you have between 3 to 6 months’ worth of expenses saved in your emergency fund. If you’re not sure how much you’ll need, perform this simple task to get your answer. Add up all your monthly expenses, and then multiply this number by 3 and 6. This gives you the lower and upper values of your emergency bank account, respectively.

- Short-term goals. These are the goals that should not drive you into debt. Short-term goals are higher value items that you should pay off completely. They include your vacation budget, computers upgrades, and gift purchases. You are putting aside part of your savings over a period of time to pay for these goods and services.

- Long-term goals. Your long-term savings are the building blocks of your future. The money put into this account can be seen as an investment and can help you become wealthy and gain financial independence.

Tip 3: Choose Where to Save

Your money should be gaining value. That’s why we recommend that you carefully consider different financial vehicles to place your savings into. The most popular types of accounts that can help your money grow slowly and without much risk are:

- Savings accounts

- High-yield savings accounts

- Certificates of deposit (CDs)

- Money market funds

- Money market deposit accounts

- Treasury bills and notes

- Bonds.

Each of these carries a degree of risk, although the risk is less than with stocks for example. Please, review each option with a critical eye.

Conclusion

For long-term financial success, you must have a deliberate approach to how you handle your savings. Follow these three simple money-saving tips to build a wise saving strategy.