June 23, 2023

Understanding the Time Value of Money: Key to Making Smart Financial Decisions

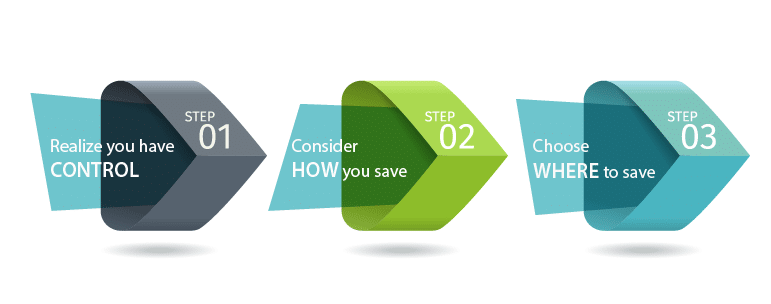

Which holds more value: $100 today or $100 a year from now? Does it depend on whether you’re making or receiving the payment? Your answer might hinge on your understanding of ‘the time value of money.’ So, let’s explore this financial concept and understand why is the time value of money important for making savvy Read more