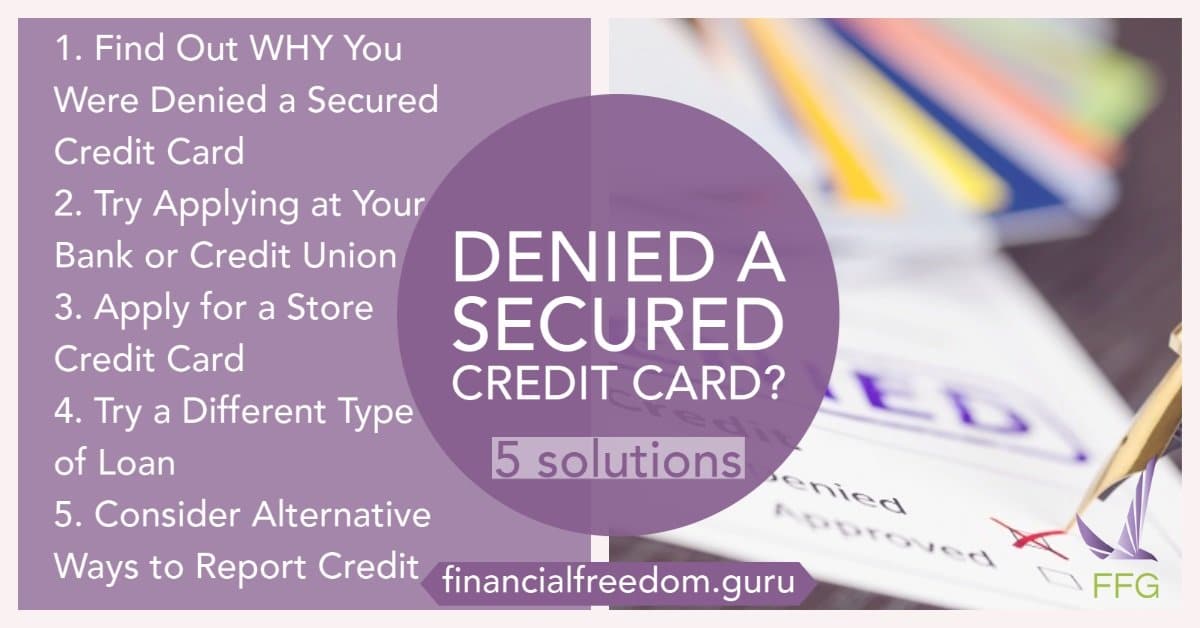

Denied a Secured Credit Card? Here’s What You Should Do Step by Step

Updated: May 19, 2022

The credit card issuer has denied your application for a secured credit card. It’s shocking, embarrassing, and you still don’t have a card. Don’t panic. We’ve created some tips on what to do if you’re denied a secured credit card.

Table of Contents

Find Out WHY You Got Denied a Secured Credit Card

You have the right to find out why you were denied credit. Contact the credit card company and ask them. The credit card issuer must send the rejection reason to you in writing. Should your denial be due to information on your credit report or not, you are legally allowed to get a free copy. Most likely, you will be able to successfully dispute any errors on your report that may have caused the denial.

Try Applying at Your Bank or Credit Union

If you are already a customer at a bank or credit union, you should apply for their secured credit card. It can make it easier to qualify for their secured card if you have a good history with them.

Apply for a Store Credit Card

Store credit cards tend to have higher APRs, but if you’re serious about improving your credit, they can help. Some stores have credit programs designed to help people build their credit scores. For example, Fingerhut.com has a FreshStart® Credit Account issued by WebBank. Once your existing balance is paid off on time and in full, with a minimum order size of $50, you will receive rewards in the form of a WebBank/Fingerhut Credit Account, which may come with an increased credit limit.

Try a Different Type of Loan

Other products you can consider are share-secured loans, credit builder loans, or no-credit-check secured cards.

- A share secured loan is a credit union loan backed by money in a savings account. When you borrow money from the credit union, you’re actually borrowing against money from that account. There is no risk to the credit union, so they may offer a low interest rate (which saves you money).

- Credit builder loans are a good option for customers who don’t have an installment loan. It can work one of two ways. You deposit the money into a bank account and can borrow up to the balance in the account. The other option is to be approved, and then pay the first installment of the loan. Once the first payment is received, then the complete loan is sent to you via check or direct deposit.

- No-credit-check secured cards are a solid, but expensive option for a secured credit card. They usually involve an application fee, and a higher APR than a secured card with a credit check. Apply for this card if you have unsuccessfully applied for a secured card, but have money for a security deposit.

Consider Alternative Ways to Report Credit

There are other ways to build good credit. You can try convincing your landlord to report your rent payments to credit bureaus, using an app like RentTrack. It’s possible to try this technique with your utilities as well. You can sign up for PRBC (Pay Rent, Build Credit). PRBC considers your bank accounts, and your utilities and rent payments, to generate a score between 300 and 800. PRBC may not be useful in getting a mortgage but can be used successfully for cellular providers or auto loans.

When You Get It, Use Your Credit Well

So you’ve managed to get an alternative to the credit card. Building credit isn’t based on luck, or on how much money you have. Instead, there are some tried and true actions to raise your credit score that always work.

- Read the terms of your credit card agreement. This agreement sets up the expectations for you and your credit card company. It explains what APRs apply, which fees, and which penalties are in the contract.

- Pay your loan (credit cards, loans, or other credit extended to you) on time, every time. You should pay at least the minimum agreed-upon amount as stated in your credit card agreement. This should be paid by the due date and time.

- Keep a low balance. It is advised that your balance should be less than 30% of the total line of credit. We recommend that you keep at 10% or less for each open, non-installment loan that you have.

- Where possible, pay in full every month. This is the easiest way to avoid paying interest.