Advantages and Disadvantages of Secured Credit Cards: Build Credit Wisely

Updated: April 28, 2022

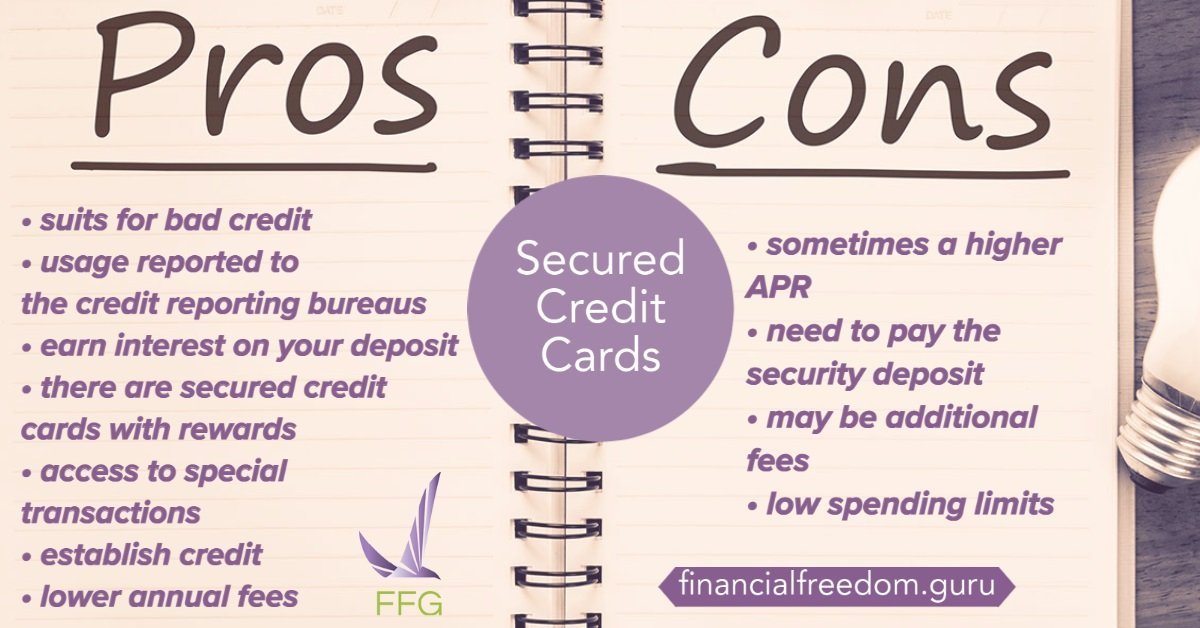

Congratulations! You’ve made the decision to improve your credit score! This is a great step toward taking control of your financial situation. The best way we can support your efforts is by providing accurate information to help your decision-making process. In this article, we’ll talk about the pros and cons of secured credit cards that can help you build credit. Keep reading, and hopefully, by the end of the article, you can decide if this option is right for you.

Table of Contents

Benefits of a Secured Credit Card

A secured credit card comes with a number of benefits for the applicant.

- You can get a secured credit card even if your credit score isn’t excellent. Financial institutions are usually willing to issue a secured card even if you don’t qualify for an unsecured one.

- Your credit card usage will be reported to the credit reporting bureaus. This builds your credit history record, creating a pattern that will eventually improve your credit. When your credit is pulled later, your secured card behavior will be reflected in the report. Your credit score will improve over time as a result.

- A secured credit card can help someone with no credit history establish credit. It is almost impossible to get an unsecured card without credit history.

- Should your deposit be held in an interest-bearing account, you can earn interest on your deposit. It is possible that more money is returned to you than you initially deposited.

- You have access to special transactions. This includes the ability to make deposits and reservations, like for rental cars and hotels. Not every rental car or hotel location accepts debit cards for reservations. You also have some flexibility in your finances to cover emergency purchases.

- Some secured credit cards are eligible to earn rewards, like cash back or rewards points on purchases.

- Annual fees may be lower than those of a comparable unsecured card.

Drawbacks of a Secured Credit Card

There are a few downsides to using secured cards.

- Some secured credit cards come with a higher APR than a comparable unsecured card.

- You need to pay the security deposit. There is no way around that.

- There may be additional fees to set up the account. These include an application fee, a processing fee, and an annual fee.

- Secured credit cards have relatively low spending limits.

Evaluate the Pros and Cons of Secured Credit Cards

A secured credit card is a powerful tool to establish and rebuild your credit. If used correctly, the benefits can form a controlled framework allowing your credit to improve to good credit. After some time, lenders will be willing to provide you with unsecured credit cards again. As you make your decision, you should analyze the pros and cons of secured credit cards. Once you get full information, you can make a decision to determine if secured credit cards are right for you.