Full Guide to the Pros and Cons of Rewards Credit Cards

Updated: November 23, 2022

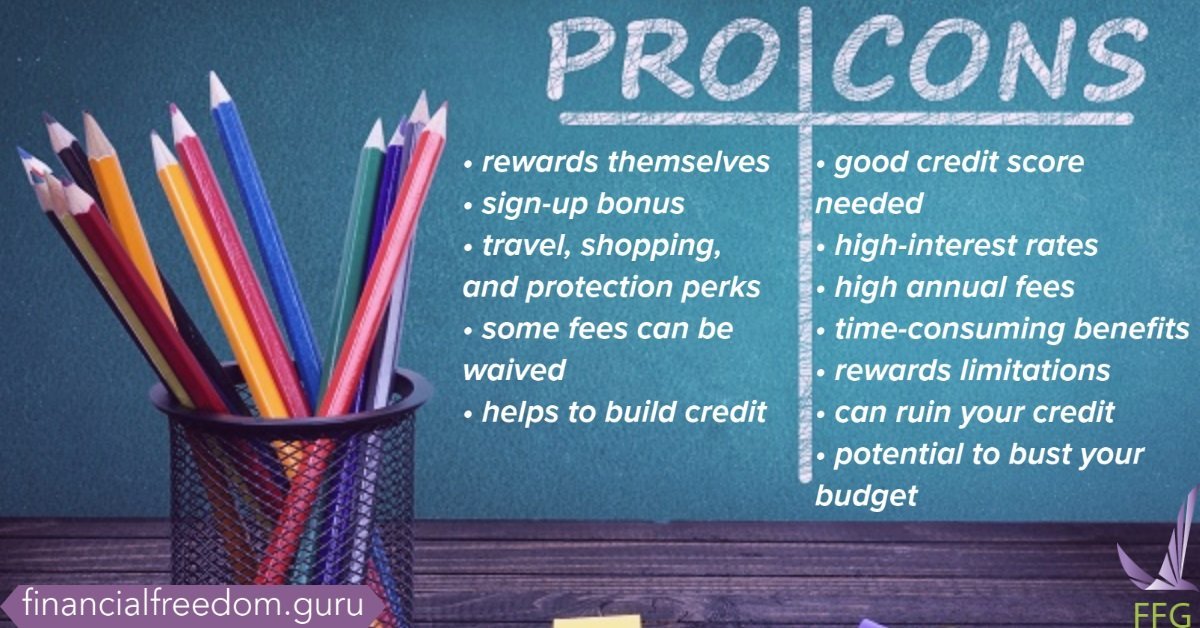

There are a lot of rewards credit cards out there. It’s all too easy to apply for a credit card that may not be right for you. If the credit card perks sound amazing, you’ll start fantasizing about all the ways you can make use of them. Yet, you may not stop to think about the impact this card may have on your finances. Therefore, it is crucial for you to review the pros and cons of rewards credit cards. Once you have a better understanding of the advantages and disadvantages, you can make a more informed decision.

Table of Contents

Pros of Rewards Credit Cards

The pros of a rewards credit card are what make the program exciting. They allow you to earn benefits which can be used for shopping, travel, or to earn a little money. They include:

The Rewards Program Itself

Your credit card can earn you cash back, points, or miles, which can be redeemed for other benefits. With the rewards program, most of your purchases may qualify.

In some cases, revolving categories purchases (purchase of a certain type) earn rewards while others do not. You can potentially earn hundreds of dollars in cash back, travel, and other rewards for redemption later.

Sign-Up Bonus

Rewards credit cards usually have premium bonuses. They require you to spend a certain amount within an introductory period. If the spending threshold is around the amount you planned to spend, the bonus can be easily met. The most premium cards offer up to 150,000 bonus points. When converted to travel benefits, this is worth thousands of dollars. It’s more common to find cards that offer 40,000 to 75,000 points. This is usually enough for a pair of domestic round-trip flights or a single round trip from the U.S. to Europe.

Travel, Shopping, and Protection Perks

Some of the best purchase protection opportunities come from rewards credit cards. Rewards cards may offer travel accident insurance, baggage insurance, free Global Entry, emergency cash replacement, and other travel perks. They give extended warranty insurance, purchase protection, and fraud protection that limits your liability when your card information is stolen.

Fees May Be Waived

Credit cards make money from interest and fees. With rewards cards, the card company may waive some of them, like foreign transaction fees. Cashback cards frequently have their annual fee waived for the first year.

Build Credit

Rewards credit cards are a good way to build your credit if you use good credit behavior. Pay off your bill every month and keep low utilization. You’ll be on your way to great credit in no time.

Cons of Rewards Credit Cards

Cons of Rewards Credit Cards

On the other hand, rewards credit cards can have some disadvantages that may make them not worth it. You can damage your financial situation if you’re not careful. The cons include:

Very Good Credit Score Needed

To earn rewards, you usually need to show you’ve been responsible with your credit. (There are a small number of credit builder rewards credit cards available.) If you’re applying for a rewards card, you will want to make sure you have the required credit score otherwise you would have dinged your credit score for nothing.

High-Interest Rates

The interest rates of rewards cards are generally higher than non-rewards cards. A 20% APR can be a great motivator to pay off your balance in full every month. Pay attention to credit cards that offer low introductory rates that increase sharply after time. Interest costs quickly eat into any benefits you may get as rewards.

Expensive Annual Fees

If you’re lucky, the credit card company may waive these fees. Provided they don’t, you’ll want to do the math to see if the benefits you’re getting are worth the annual fee. Also consider, if they are worth it, will you use them enough to justify the cost?

Lost Time Dealing with Managing the Benefits

If you have a card with rotating categories, you need to spend time chasing categories to maximize the rewards. This quarter it may be schoolbooks and clothing, but by Thanksgiving, it may be travel costs. Then there is the time lost maneuvering around blackout dates. You’re trying to rearrange vacation days and schedules so that you can finally use your travel rewards. Flight rewards may not be used on holiday weekends or from December 15th until a week after New Years Day. You may be limited in which airlines, hotels, and rental cars you can use. If this sounds like too much of a hassle, consider a flat-rate rewards card, which offers less time-consuming rewards.

Rewards Limitations

Pay attention to the fine print in your credit card agreement. Some credit cards place maximums on the rewards you can earn. Other cards may force your points to expire, or not allow them to roll over to the following year.

Can Ruin Your Credit

You should have a card that gives you the best rewards with balances you can comfortably manage. By “manage”, we mean to pay off in full at the end of the month. Your credit is affected by several factors, including your payment history and your utilization. If your rewards card is negatively affecting either of these factors, your credit will suffer.

Potential to Bust Your Budget

You planned to spend a certain amount on your card, but you spent more to reach the rewards. If you’re using more money than planned to earn benefits, your card may not be as valuable as you perceive it to be.

Avoid the Cons of Rewards Cards

Reviewing the pros and cons of rewards credit cards is a solid strategy to assess a card’s benefits. You should keep in mind that it’s possible to avoid some cons of reward cards. It takes the same good credit habits we always recommend. Pay your bill on time and in full every month. Keep your balances low. Spend only what you’ve planned. Protect your credit score. Pay attention to interest rates. Read the fine print.

Cons of Rewards Credit Cards

Cons of Rewards Credit Cards

Rewards cards like flybuys they are worth having because you’re spending the money anyway so why not get rewarded for your loyalty. I’m not sure about credit card rewards because I’m not stupid enough to spend more than I can afford

That’s a smart approach, if you are spending money anyways – then get the rewards, but don’t spend money just to get rewards.

My personal lifehack – I place everything on my card and pay at the end.. I use my cash back to pay back bills when needed

You can probably find a higher redemption rate, but if you don’t actually need points for anything else – that works.

If your spending habits don’t change and you still get some benefit from it, then it’s perfectly fine to have rewards cards.

Agreed, use the rewards cards for your own benefit!

If you pay reward cards off in full monthly than thy are really worth it. Free shipping and rewards are always a great perk

And all of the protections you get from the Credit Card. Came in really handy during these times when I need to cancel few flights, ended up doing it through the Credit Cards

Rewards cards are good if you have the discipline to pay the purchases off and stay within spending budgets.

I have an app for mine and I check the purchase amounts daily or at least a couple times a week and pay that amount off right away through the app. If you let it go longer you might be tempted to just pay some of it (that’s what they hope you do).

The app will also show you your rewards balance.

Good for you Gary, some might say that is too much, but whatever it takes to stay disciplined and still reap Credit Cards Rewards

I use capital one and get cash rewards. I dont charge much and always pay them off every month. I also have the app on my phone so I keep track daily if I need to. I have had good luck with capital one cards abd building my credit

Yeah, Capital One cards are pretty good at building credit. Actually, my first credit card ever was Capital One for Students with $300 limit. I paid off that sucker each month for around 9 months and then credit card offers started to pour in.

definitely rewards cards are worth having. it adds up when you start putting your bills on your credit cards that’s free cash back can go wrong with that. you were going to pay it with your debit card anyways so its a smart way to get something out of it and reward yourself for paying bills.

Agreed, Credit Cards are not evil per see, it’s how you use it. You can actually become slightly wealthier by using Credit Cards.

As long as you’re extremely disciplined and hate carrying a balance rewards cards are worthy. I am a bit extreme and make payments several times a week, as soon as the charges post. The Chase Sapphire Preferred card has an incredible 80k rewards points bonus going on now.

Yes, you have to payoff the balance in full each month. I have a bank send reminders and also have a recurring event in the calendar to remind me that credit card bill is due

it’s actually better for your credit score to pay on the due date compared to paying early.

Interesting, did not know that. My credit has been sitting between 797 and 800 for a while, maybe doing that would push it past 800. I may give that a shot.

I think rewards cards are good under two conditions. They’re great if understood and used correctly.

1. If the balance are paid in full each month

2. It doesn’t increase your spending.

Agree! Can’t FIRE with debt. Fidelity offers 2% cash if you have a broker account with them. I am never sure with travel perks if I am getting a good deal or not.

I agree with you to a certain extent. I think using debt in a controlled manner is okay. You can’t be over leveraged. I.e. buying a house all cash will take a while (normally)I think you’re doing a great job with the 2% because it’s scheduled investing for your retirement plan

If you can take a loan for 2% it is always good, as you will be earning around 6% with a boring ETF

I would argue that you can FIRE with debt if you have enough cash-generating assets to service the debt that helped you create the leverage to acquire the assets.

100% agree, only spend what you would have to spend anyways and pay the balance in full otherwise the crazy APR will erase any savings.

Rewards are great, but credit card companies are hoping you won’t pay off your bill every month so they can get that interest payment!!!

Yeah! Agree with that 100%. I think the majority of people might spend more or won’t pay in full. It’s a good idea to try to watch your spending and budget actively so you know where you are over spending

Yes, your job is to be a bad customer for a Credit Card by never incurring interest charges!

I have a credit card with reward miles, which I just use to pay the usual expenses (utilities, food, gas, etc.) and have earned enough reward miles for almost 3 rountrip flights to Europe over the course of 18 months. There’s also plenty of cards with cash rewards if you’re not into free flights.

Rewards cards only bad if you use them to buy things you can’t afford. That kind of leads to a bad debt down spiral.

Agreed, Credit Cards are not good or bad, it’s how you use them!

The value in credit card rewards comes from opening multiple CCs for their sign up bonuses. I currently about 2M points across various point carriers (airlines, hotels, general points ie Chase UR). My monthly spend is around $2k.

My Chase points total around 700,000 points which I could redeem for $7,000 in cash or use towards point redemptions.

Totally worth it provided you don’t carry balances and can keep track of everything.

Yeah, just to be careful with how it impacts your Credit Score and make sure that don’t break Chase 5/24 rule

If you are disciplined – that’s OK. We earn $700 in discover card rewards each year which we cash out for gift cards for our kids clothes and gifts. I have 57k Southwest miles from their card. Just pay off every month and don’t buy stuff just to get rewards. We have reoccurring bills charged to our cards like internet, electricity etc

Totally agree. Curious to see what’s your redemption rate on gift cards? I find that with my card the redemption rate is only 1% on gift cards, vs. around 3% on the flights

This is debatable but we use our cash back rewards to pay for vacations. Of course pay them off every month.

Some say that cc make it easier to spend. We are on a strict budget so that doesn’t seem to affect our household.

We agree all of us pay off credit card balance each month in full for years now. It just like another bill, maintaining the balance on it is not an option.

Yes yes yes. I carry cash for merchants that charge additional fees to use CC but otherwise I get my 1.5-5% cash back. It also builds your credit. Mine is over 800. There is no reason not to.

The only reason is if you can’t stay disciplined to payoff your credit card in full each statement cycle

I like my capital one venture card however once I captured the rewards I stopped using it. There is a sign on bonus if you spent 3000 I believe you get 50,000 rewards with I used towards travel

Nice! Hopefully, you get to use those travel rewards soon!

Citicard 2% cashback card. 1% when you buy, 1% when you pay off. I also keep chase and discover for the 5% back on grocery months, amazon, and paypal, etc. probably get about 500 a year in cash back

Nice credit card portfolio

Yea! I pay everything that I can pay on it that won’t charge me. Some will charge you a fee to use a credit card rather than a debit card.. but if very minimal or if no fee… then absolutely. rent, car, bills, groceries, every day spending, new car purchase, big purchases etc… I even pay my taxes with it (again, as long as fee is worth it depending on points or if no fee). All goes into that card. I rarely use my debit card or cash.. then I pay it off every few days to every week. I… Read more »

Staying disciplined with Credit Cards is the key to use them for your own benefit. I do know some of the services that let you pay rent via credit card, but I don’t depending on your redemption rate, those fees can be too high. Will need to investigate more

My business revolves around buying amazon products so I will end up getting the AMAZON Store Card with 5% cashback.

We buy most of our stuff for both business and home on Amazon, so Amazon Credit Card was a no brainer

As long as you use it to pay for stuff you would pay for normal (essentials food, water, gas, restaurant, etc.) Not non essentials clothes games, tickets, etc. pay cash for these kinds of things. Use a budget system and you will be fine I have been doing it this past year not a problem.

That is the key, only spend money that would spend anyways. Do not spend just to get the rewards on get into the new tier

I think the rewards are generally pretty small. You have to spend a lot to make them worthwhile. But then again, even a small savings is better than no savings. Just be sure to pay it off monthly and be careful if it has an annual fee. I do have an Alaskan Airlines visa. I like it because I get an annual companion fair for $99. That alone can save us hundreds of dollars when we travel. I would have to spend a crazy amount of money with other types of rewards cards in order to equal hundreds of dollars… Read more »

The rewards add up, especially if you combine credit card points with regular loyalty points and use sites like rakuten, you can get to up 10% cash back sometimes

Rewards cards are good desion as long as you only put what you’re already spending on it

That’s the key. We do not encourage you to spend more money. We want to make sure you are getting the best cashback for the money you are already spending.

If you are susceptible to debt rewards credit cards can become a real problem for you. They are beneficial for those who are really disciplined with their finance

Very true, credit cards are built in a way to make sure that you will pay interest. So if you feel like you can’t handle it, then rewards are not worth it – just use a debit card. There are now debit cards with cash back offers as well

Love mine. Do your research to see which one will benefit you most, then pay what you would anyway for bills or groceries on it, but pay it off every month (I pay mine off every week), don’t spend anything you don’t have $ to pay off already, never pay interest, never late payment, build credit. Reap benefits, enjoy rewards but none of the consequences. I put everything on it so get a lot of points. Many free flights the last few yrs already.

Yeah I’ve been flying a lot with my family, by simply putting every expense I can on the credit card. You do need to be very disciplined though as one missed payment to credit card can’t wipe off all of the savings you can potentially get.

If you’re in Canada, I recommend PC financial card. They have plenty of use. You can earn points from Esso, Mobil, Shoppers, no frills, and Superstore. You can earn points from your essentials and save points to redeem for the same.

Or you can also get those rewards+ points earning credit card that converts your points to investment dollars to buy stocks. (RBC visa).

Wow I didn’t know you can use your credit card points to buy Stocks. I have PC Optimum points, not the credit cards. I find that when you shop on 40X days at Shoppers you get like 10-15% cash back which is major. Now every time before I shop I check PC optimum app to see what’s the deal are and when is the 40X day

We’ve used YNAB for years. We set a budget and stick to it. All spend goes on credit cards, and is all paid monthly. And I typically earn about $1500 in annual rewards.

good point. I suspect the FIRE group is a lot more disciplined than the average card user.

Yeah if are using YNAB you definitely have a discipline to payoff your credit cards in full every month. I find this software cumbersome to use, but whatever it takes to stay the course

There is statistic that we spend more using a card opposed to opening a wallet and handing the cash to someone? If your grocery budget is $60 and you only have $60 on you you’re putting items back. With a credit card that $73 bill is “close enough!”

I think that’s true to a certain extent. As any piece of research there’s multiple factors that weigh into it. If you make a list and stick to the list, then you won’t overbuy. If someone’s already a minimalist. Also, sometimes the cash method can fail you, seeing as having to put something back on a list of items you need makes it so you either have to go to an atm and still spend more or just pull out a card for the difference.

This is a fairly antiquated view.

Some people abuse credit cards, some people abuse cash.

Many people use cash responsibly, many people use credit cards responsibly.

If you can use credit cards responsibly they are a great tool for budgeting and wealth building.

Antiquated or not, I wouldn’t claim “wealth building” from using a credit card. Maybe someone who travels extensively for business and uses their card for all those reimbursable expenses might get some actual value out of it. Doesn’t work for me. I’m not spending enough in the first place to get more than a couple bucks a months in cash back.

I have had thousands worth in credit card cash back and other rewards over the years.

Never spent a penny more than I would have if I had been using cash.

I just get everything I buy for cheaper than everyone else who doesn’t use cash back credit cards. It all adds up and goes towards the end goal.

I don’t know if you have the source for this statistic, but it’s probably true. Your job is to not be part of that statistic. Especially right now the contactless payments are here to stay. The sooner people learn to disciplined with the digital currency, the faster they will be able to build wealth. Using cash is not the answer

if you have self control the benefit of credit card points for money you would have spent anyway is well worth it. We get free flights free hotel rooms cash back etc

Credit Card points is how I was able to afford half of my family vacations

Just remember that credit is to be used as a resource to establish trust between you and a creditor. Later it can be used for larger purchases that people wouldnt typically be able to pay for with cash. Cars, homes, etc. Do not use credit as a means of survival.

For sure Credit is not your money in the bank, you only need credit to get leverage for these big purchases.

We pay all the bills we are able to on two credit cards. Roughly $4,000 per month goes on the two (and is paid off- we don’t carry a balance). That is a lot of rewards.

Yes we do the same, it also gives you protection on top of the rewards

I have 3 capital one cards. They are the ones I have the best luck with, no annual fee. Interest rate is high but I pay them off every month.

That’s the capital one trifecta!

Nice overview of credit cards pros and cons. I have always consider them useful but I advise you to keep an eye on paying your full balance every month.

Yes very true, even if you miss the whole balance one time all of the potential rewards can be wiped off due to the extremely high APR

Credit cards I believe are not bad if you are disciplined to pay in full every month. I put my recurring expenses on it, phone, electric, water etc. I get one with cash back and I get to build my credit as I use it. I also get one with NO annual fees.

For sure, that is exactly how we suggest using them. Put on them what you would spend anyway, always payoff the balance and utilize the rewards you wouldn’t have otherwise.