Why You Should Have a Credit Card with No Annual Fee

Updated: April 7, 2022

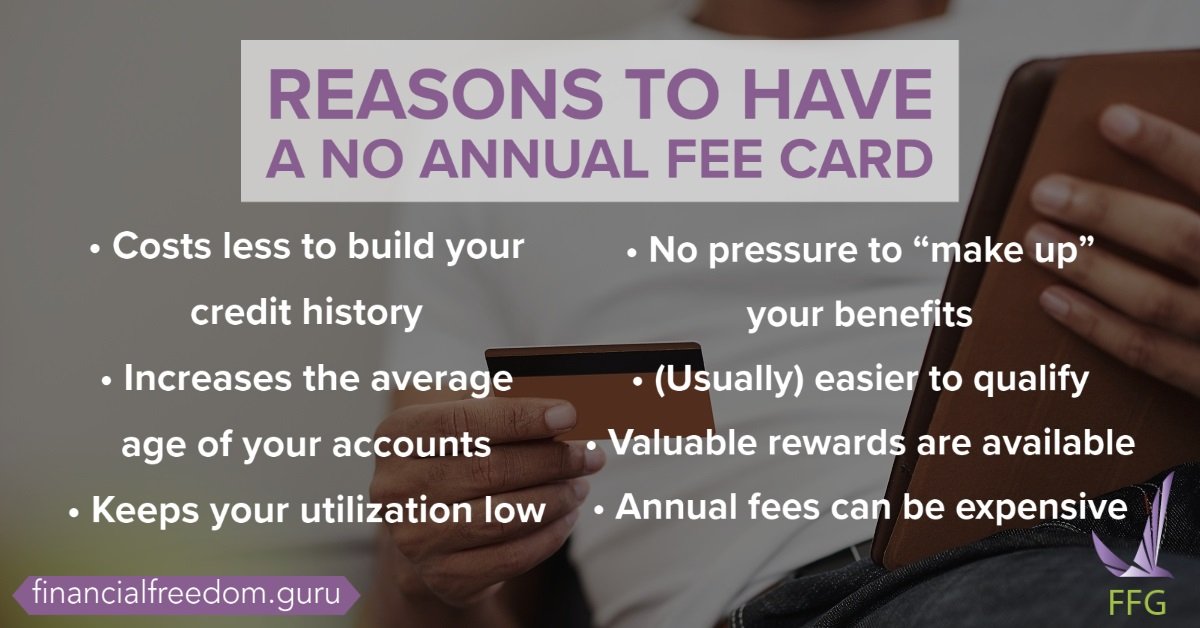

If you’re looking for a good way to maximize credit card benefits and minimize your costs, listen up. A credit card with no annual fee is one of the best ways to meet this goal. No fee cards offer all the basic perks of credit cards without costing you an annual maintenance expense. We’ve listed some of the common advantages of why you should keep a no fee credit card in your wallet.

Table of Contents

- A Credit Card with No Annual Fee Costs Less to Build Your Credit History

- Increases the Average Age of Your Accounts

- Keeps Your Utilization Low

- No Pressure to “Make up” Your Benefits

- (Usually) Easier to Qualify

- Valuable Rewards are Available

- Annual Fees Can Be Expensive

- Make the Most of a No Annual Fee Card

A Credit Card with No Annual Fee Costs Less to Build Your Credit History

Lenders look at your credit history to determine if they will grant you credit. Your insurance company, your employer, utilities, and landlords may use it too. When your credit history is bad, lenders will be reluctant to extend credit. If you are approved, the amount offered may be lower than requested with higher interest rates.

Both sets of cards have this functionality, but the credit card with no annual fee doesn’t cost you money every year. You can keep building your credit even if you can no longer afford the annual fee card.

Increases the Average Age of Your Accounts

The average length of your credit history is worth 15% of your credit score. This is the sum of the ages of all your credit lines divided up the number of credit lines. Then it is rounded down to the nearest year. If account A is 34 months old, and account B is 121 months old, your average age is 6 years. (121 months + 34 months = 155 months. 155 months ÷ 2 accounts = 77.5 months per account. This is equal to 6.45 years, or 6 years if you round down.)

A no fee card will help build the age of your account without costing you any money. However, canceling a no fee card can result in a drop in the average age of your credit history.

Keeps Your Utilization Low

Utilization considers how much of your credit limit you are using as a percentage. It’s the total amount of your outstanding balances divided by the sum of your available credit. Low utilization (under 30%) is good. It shows lenders that you are able to manage your credit appropriately and are more likely to pay them back. No-fee credit card limits are included in utilization calculations. If you cancel your no fee card, you decrease your available credit without proportionally reducing your debt. Your utilization increases, resulting in a lower credit score.

No Pressure to “Make up” Your Benefits

With a credit card that has an annual fee, you may feel the need to justify the cost. In doing this, you may take on unnecessary debt. You may feel like you need to take more trips or enroll in certain programs to enjoy your card’s bonuses. With a credit card with no annual fee, there is less urgency to use the other perks associated with the card. You are more likely to take a trip when you can afford it and not out of credit card obligation.

(Usually) Easier to Qualify

In general, it is harder to get a card with an annual fee than it is to get a no fee card. (It should be noted that credit card companies use complex formulas to determine your creditworthiness. Therefore, we cannot guarantee that you will qualify for a no annual fee card.) Despite this, you may be approved for a no fee card with less effort. This may be true even if you don’t have good or excellent credit.

Valuable Rewards are Available

Many cards with no annual fee offer valuable rewards to their customers. For example, the Chase Freedom Unlimited credit card offers 5% cash back on travel purchases, 3% on some other categories, and 1.5% cash back everywhere else.

Annual Fees Can Be Expensive

Annual fees can range from $25 to $500, depending on the card’s benefits. You can try getting your charge waived, but it can be an additional hassle. Not paying the fee may give you a derogatory remark on your credit. Card issuers may ask you to use points or spend a minimum amount over the year to cover this expense.

Make the Most of a No Annual Fee Card

Many people believe a credit card with no annual fee offers inferior benefits to one with a fee. They automatically assume that paying an annual expense unlocks better perks. While this may be true sometimes, cards with no fees give their users better benefits towards their credit. Canceling these cards is a bad idea. You should keep them, and make the most of the benefits they offer.