Are Credit Cards with Annual Fees Worth It?

Table of Contents

- Annual Fee Basics

- When Are Credit Cards with Annual Fees Worth It?

- Your spending habits match the rewards offers

- The benefits of the card more than offset the annual fee

- You know you will use the benefits regularly and frequently

- Your card grants you services you would have paid for anyway – for free!

- The card comes with a (much appreciated) 0% interest rate

- Canceling the card will hurt your credit score

- You can’t qualify for a no-fee card

- Make the Right Decision

Last Updated: May 20,2022

You probably think you’ve found the perfect card. It has a low interest rate, gives rewards, cash back, and the other benefits that fit your lifestyle perfectly. There is one problem with the card: you’ll end up paying an annual fee. Are credit cards with annual fees worth it? Don’t throw away your application just yet. There are times when paying an annual fee makes sense (and there are other times it’s just not worth it.) We recommend that you understand if paying the credit card’s annual fee is right for your situation. Only then you will know if to proceed with your application.

Annual Fee Basics

The annual fee is an automatic charge added to your account once per year. This fee pays for the extras that you get with your card. Your annual fee covers the perks, insurance (and other protections), and your membership for the rewards program. The benefits are often supplied by third party companies and are paid for by the credit card’s annual fee. Most annual fees are between $19 and $100. There are a few exclusive cards with an annual fee as high as $500.

You can find annual fees on cards with more exclusive benefits. For example, this may be cash back cards with the highest rebate rates. Annual fees are also generally found on travel rewards credit cards. Other cards with annual fees may be premium credit cards, rewards card, and secured credit cards.

Some cards waive the annual fee for the first year. This gives you an opportunity to test out the benefits without the burden of payment. At the end of the year, you’ll receive notification that the annual fee will be charged. If you don’t think that the annual fee is worth it, you can cancel the card.

Be careful if you decide to close the card. This will affect both your card’s utilization and the age of the credit card. This negatively impacts your credit score. If you intend to cancel the card, start performing activities that will raise your credit score. It will make your score more robust against the decrease that accompanies canceling a credit card.

When Are Credit Cards with Annual Fees Worth It?

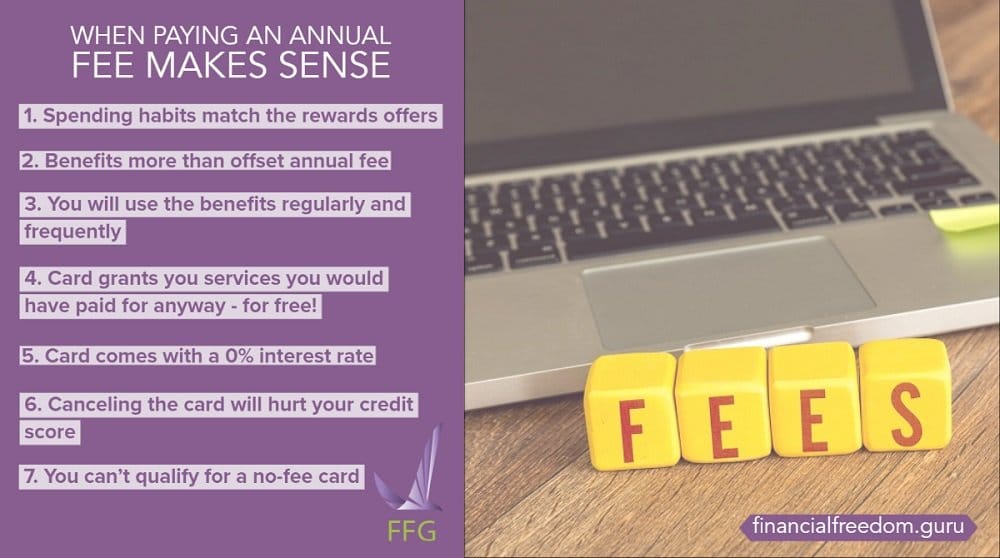

Still not sure whether should you pay the annual fee? The following situations are some good reasons for when paying an annual fee makes sense.

Your spending habits match the rewards offers

Look at the way you make your purchases with your credit card. Do you spend your credit in a way where it is easy to earn and maximize credit card rewards? What is the difference between how you’ll need to spend credit on the new card and your actual spending patterns? If this difference is marginal, paying an annual fee is worth it.

The benefits of the card more than offset the annual fee

There is an effortless way to determine if the benefits are worth the cost of the annual fee. Compare the cost of the annual fee to the dollar value of your perks. If the value of the benefits of the card is higher than the expense of the annual fee, you should get the card. When considering the cost of the benefits, look at the ones that you will use. It doesn’t make sense to take cost-prohibitive or inconvenient benefits (that you won’t use) into account. Including them will inflate the value of the benefits incorrectly.

You know you will use the benefits regularly and frequently

The way to maximize credit card benefits is to use them consistently and often. Paying an annual fee to collect airline miles when you have few opportunities to use them makes little sense. “Cost-per-use” is where you divide the price of the item by the number of times you use it. The more frequently you use something, the less the item costs per use. So, if your annual fee costs $100, and you use the benefits once, the cost per use is $100. However, if you use the benefits twice, the cost-per-use drops to $50. Use the benefits 20 times over the year, and the cost-per-use is $5. Keep increasing the use, and the cost will keep decreasing.

Your card grants you services you would have paid for anyway – for free!

If you’re getting paid services for free, the card is saving you money directly. Chances are the credit card company negotiated a bulk discount for these services. Therefore, the annual fee costs less than if you were paying for all the services out of pocket.

The card comes with a (much appreciated) 0% interest rate

0% APR cards are fantastic if you manage your spending and pay off the card before the introductory period expires. By law, you get a minimum of 6 months with 0% interest on new purchases, balance transfers, and in a small number of cards, both. The better your credit, the longer the introductory period for which you can potentially qualify, up to 21 months. You’ll pay the annual fee and a balance transfer fee but potentially save a lot more money in finance charges. Just ensure you adhere to the credit card agreement, and pay off your balance before the promotional period ends.

Canceling the card will hurt your credit score

You went ahead and got the card with the annual fee. Now you don’t think it makes sense to hold on to it anymore. Before you cancel the credit card, you should assess the impact of canceling that card on your credit score. Closing accounts affects two factors of your credit score: the age of your accounts (worth 10%) and utilization (worth 30% of your score). If closing the card reduces the age of your account, it will be reflected in your score. Utilization is the ratio of used credit to available credit on your account. By closing the card, you are reducing the amount of available credit without a proportional decrease in credit Your utilization increases and your credit score is affected negatively. If you can cancel the card without negatively affecting both the age of your account and utilization, do it. Otherwise, it may be worth it to pay the annual fee for another year while you figure a better way.

You can’t qualify for a no-fee card

Sometimes your credit score is not strong enough that you can be eligible for a credit card without an annual fee. If you are looking to build your credit, your options are limited. You should then find a card with a low annual fee, and practice good credit card habits. This includes paying it off each month, keeping balances low, and paying attention to the credit card agreement. Eventually, you’ll improve your credit to the point that your options will grow.

Make the Right Decision

While we’re not fans of paying annual fees, there are times when the answer to the question “Are credit cards with annual fees worth it?” is “Yes”. If you can justify the card with any of the reasons above, you have a strong reason to pay for a credit card. If not, you may want to review your choice and look at a no annual fee card.

I hate the fees but they do keep increasing my credit limit so I tolerate them. I stopped using the card a long time ago. I just keep it for the credit limit and extreme emergencies.

That’s the way to do it, if you don’t use it all though they might close after 24 months of inactivity. It’s good to do a purchase sometimes and so you don’t forget, pay it off right away.