Understanding a Credit Card Statement: a Guide

Updated: November 28, 2022

Credit card statements are usually approached with fear, denial, and confusion. Unless we have kept a tight grip on our finances, we tend to fear the balance we owe. Then comes the denial: we can’t really owe this much money, can we? As we stare at the credit card billing statement, we’re full of confusion. What do all the pages of information mean?

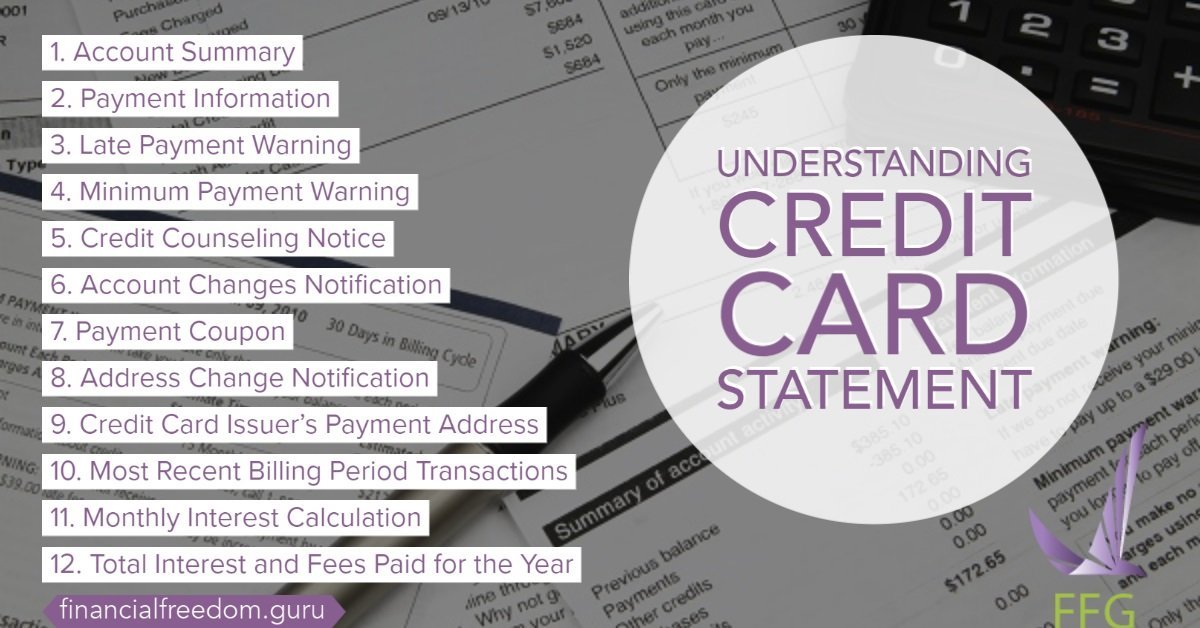

Fortunately, you’ve got us here to guide you in understanding a credit card statement. (Sample credit card statement.) In this article, we’ll break down the parts of your bill, and explain the purpose of each part. Once you comprehend the bill section by section, it won’t seem as mystifying or as scary as it used to.

Table of Contents

- Understanding a Credit Card Statement: a Brief Overview

- An In-Depth Look at the Parts of a Credit Card Billing Statement

- 1. Account Summary

- 2. Payment Information

- 3. Late Payment Warning

- 4. Minimum Payment Warning

- 5. Credit Counseling Notice

- 6. Account Changes Notification

- 7. Payment Coupon

- 8. Address Change Notification

- 9. Credit Card Issuer’s Payment Address

- 10. Most Recent Billing Period Transactions

- 11. Monthly Interest Calculation

- 12. Total Interest and Fees Paid for the Year

- Bonus Section: a Rewards Summary

- Understanding a Credit Card Statement Helps You Develop Good Credit Habits

Understanding a Credit Card Statement: a Brief Overview

Your credit card company has a legal obligation to send you a statement every month. It may be sent in the mail, as a paperless statement that you log into your account to retrieve monthly. Credit card statements must arrive more than 21 days before your minimum payment is due. This window is so that you have a fair chance to pay your bill on time.

An In-Depth Look at the Parts of a Credit Card Billing Statement

Your credit card billing statement has twelve distinct sections. Some sections are to remind you about your credit card behavior over the month. Other sections are meant to inform you and may be mandated by law to be placed on the statement.

1. Account Summary

Account Summary is an outline of the status of your credit card account. This is the most important section of your credit card statement and it’s usually found on the front page. It lists your current balance, interest charges generated, and any fees applied since your last statement. The amount of credit you have available and your billing cycle end date are also shown here. Your statement won’t include any activity after the billing cycle end date. You will find this activity in your online account.

2. Payment Information

Payment Information discusses what you need to know in order to pay on time. Take note of this section since it will protect you from penalties due to late payments. Here, your minimum payment and due date are given. Missing this payment due to insufficient funds, or not paying on time will result in a late fee. If you’re late by 60 days or more, your interest rate will be raised. In both cases, the credit bureaus will receive information about your late payment.

3. Late Payment Warning

Late Payment Warning explains the consequences you’ll face if you pay your credit card bill late. It describes the late fees and penalty APRs that will apply to your account. Your late fee will be $25 or your minimum payment, whichever is smaller. It will be raised to a maximum of $35 if you’ve had a previous late fee within the last 6 months. As for your APR, it will only be raised if you’re delinquent on your payment for 60 days or more. So your interest rate is safe until you’ve missed two payments. It stays at the penalty rate until you’ve provided six payments consecutively on time. Your creditor may choose to lower it or leave it in place, as it applies to your existing balance.

Your card issuer will report your past-due account to the credit bureaus if they are more than 30 days late. Even after you make your account current, your credit report will show the late payment for the following 7 years.

4. Minimum Payment Warning

Minimum Payment Warning is a requirement that your credit card company must provide. It explains what will happen if you only pay the minimum amount every month. This shows how long it will take, and the total amount you’ll pay, including interest (assuming you make no new purchases). It also shows the same information if you were to pay your balance off in 36 months (3 years). (You can use our credit card payment calculator to see how your payments change as you modify the payoff time.)

5. Credit Counseling Notice

Credit Counseling Notice is another mandatory section. Your credit card company must provide the contact information of a not-for-profit credit counselor. This is in case you have trouble meeting your credit card payments. If your delinquencies are due to short-term, more manageable problems, you should work with your credit card company first. They may have programs or levers in place to help you and minimize the impact on your credit and your debt. If you choose to use credit counseling, you should review all available information carefully.

6. Account Changes Notification

Account Changes Notification lists any changes to your credit card account. This includes any new or upcoming fees, changes to your interest rate, and the effect dates of the changes. Your credit card issuer may follow up on these changes with separate correspondence.

7. Payment Coupon

Payment Coupon is a detachable slip you should include when making your card payments in person or by mail. It captures the key information needed for processing your payment and applying the funds to the correct account.

8. Address Change Notification

Address Change Notification ensures that your bill gets to your correct address. If you have moved, or there is an error in your address or phone number, you should update this information. Check the appropriate box, and put your information in the relevant section. If this section is not indicated, put it on the back of the payment coupon, and send it to your card issuer. Alternatively, you can call your card issuer or update your information online.

9. Credit Card Issuer’s Payment Address

Credit Card Issuer’s Payment Address is pre-printed on the payment coupon. You can use the coupon in an envelope with a window to mail your payment. If you use another type of envelope, carefully copy the address to guarantee the payment goes to the right place. The address can also be used to set up your creditor in your bank’s online bill payment system. Note that this is the payment address. If you are writing to your creditor for a different reason, like a billing dispute, you may need a different address. This may or may not be provided in your billing statement.

10. Most Recent Billing Period Transactions

Most Recent Billing Period Transactions allow you to verify that the transactions over the last billing cycle are correct. You should immediately dispute any charges which appear to be erroneous or fraudulent with your creditor. An incorrect charge may be theft by the vendor (or an employee), or worse, identify theft. Fraudulent charges should be dealt with as soon as possible to minimize your liability.

11. Monthly Interest Calculation

Monthly Interest Calculation calculates the interest for each balance carried on your card, then sums them up. Your credit card carries more than one balance at a time. There may be balances for past debt, new purchases, promotional interest rates, cash advances, or other purposes. Promotional APRs and their expiration dates will be listed here.

12. Total Interest and Fees Paid for the Year

Total Interest and Fees Paid for the Year tracks interest and fees paid for the year. You should use this section strategically to save money. See what fees you can eliminate, or ask your creditor for a temporary waiver. Use your good credit behavior as leverage to negotiate a lower interest rate. Creditors may be willing to help reliable customers who pay as agreed and on time. Even if your requests are unsuccessful, you can use this section to motivate you to pay down debt faster. Having less debt means paying less interest.

Bonus Section: a Rewards Summary

A Rewards Summary shows the overview of your card’s rewards status (if you have a rewards credit card). It is usually included in your credit card billing statement. Rewards summaries show your previous balance, this month’s earned points, any redeemed rewards, and your new balance. If you have any awards ready for redemption, they will be listed here.

Understanding a Credit Card Statement Helps You Develop Good Credit Habits

We know that was a lot of information, but it was necessary for understanding a credit card statement. We reviewed all the sections of your bill so that you know the function of each one. Now that your credit card statement is less intimidating, you can use it as a tool for better credit habits.