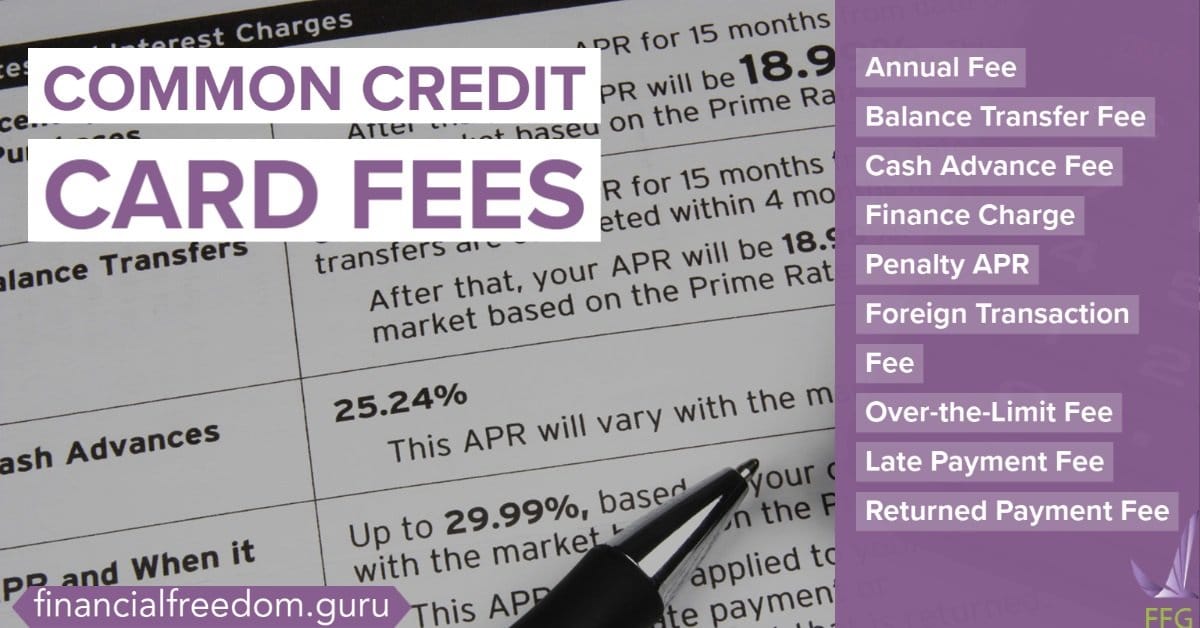

Common Credit Card Fees: 9 Types & Tips To Avoid Them

Updated: November 29, 2022

Your credit card issuer generates income using credit card fees. Some of them are related to the maintenance and operation of the card. Others are penalties for bad credit behavior. Unfortunately, it’s impossible to get a card with no fees included. The next best thing to do is understand the different types of fees. Then you can apply for cards that waive certain fees, and avoid triggering other ones on your account.

Table of Contents

Common Credit Card Fees

1) Annual Fee

This is a fee charged once per year for the use of the credit card. It is more often found on many secured, subprime, and premium credit cards, and charge cards.

For example annual fees may be as low as $19 or as high as $500. Sometimes, your credit card issuer may suspend the annual fee for the first year. They think that you’ll be willing to pay the fee next year after you experienced the card’s benefits.

Whether an annual fee is worth it depends on if you appreciate the benefits for which you are paying. If you think it’s worth it, you can try asking your credit card company for another waiver. Should the credit card company decline, then you either pay the fee or switch to a no annual fee card.

2) Balance Transfer Fee

Cards with a balance transfer fee will allow you to move debt from one credit card to another with a low promotional APR. The minimum period is six months, but customers with great credit can pay 0% APR for up to 21 months.

You’ll pay a balance transfer fee equal to the greater of 3-5% of your balance, or $5-$10. (The credit card issuer may waive this fee if asked. When deciding on a balance transfer card, you must determine if the interest savings exceed transfer fees you may have.

A balance transfer calculator can show you if you will save money on the new card.)

3) Cash Advance Fee

When you withdraw cash from your credit card at the ATM you are requesting a cash advance. Writing credit card convenience checks, or using overdraft protection to cover excess credit beyond your limit count as cash advances. In both cases, you’re taking an advance, or borrowing, from your credit using cash.

The cash advance fee may be 2-5% of the transaction, but usually accompanies ATM fees and high interest rates. It’s best to avoid this method when withdrawing cash.

Unlike other balances on your card, your cash advance balance begins generating interest from the time of withdrawal. In contrast, your new purchase balance incurs interest when your payment is late.

We recommend that you apply for a card with no cash advance fee. If you really need cash, use a checking or savings account as your source.

4) Finance Charge

This is the monthly interest charged on your account for balances past the grace period (your due date). You’ll see a finance charge applied to outstanding balances plus the new balances incurred. Carrying a balance month to month can cause you to lose your grace period. This is easy to reinstate: just pay off your card in full for up to two consecutive billing periods.

There are a few ways to avoid finance charges:

The first is to completely repay your monthly credit balance by your due date. If the monthly payments are overwhelming, see if you can qualify for a low or 0% APR balance transfer card. When you get it, you will pay less in interest. You should use our credit card calculators to assess your debt. You’ll see the time needed to pay your debt with your current monthly payments.

Our calculators can tell you the monthly payment needed to pay off debt by a certain time.

5) Penalty APR

This is the higher APR applied to the existing and future balances because your payment was 61 or more days late (This is the most common reason for a penalty APR to be applied. Per your credit card agreement, there may be other situation that can trigger the penalty rate.) Your penalty APR can increase your interest rate to 29.99%.

If you’re looking to avoid triggering this rate hike, you must make at least the minimum payments on time. Using our Credit Card Minimum Payment Calculator can help you get a better handle on the situation.

There are other actions you can try, like talking to your lender or being familiar with your credit card agreement. It is also recommended that you pay attention to your credit card statements and maintain low credit card balances. If you’re looking for a new card, consider one with no penalty APR, like Citi Simplicity® or Chase Slate®.

6) Foreign Transaction Fee

This is a charge for purchasing items in a foreign currency. It may also apply to purchases made outside of the U.S. even if the charge is in U.S. dollars. Not every card has this fee, but those that do apply it for 1-3% of the amount borrowed.

The most successful way to avoid this fee is to get a card that doesn’t charge it or use cash.

7) Over-the-Limit Fee

Before the Credit CARD Act of 2009 was passed, you were charged a fee when you exceeded your credit limit. This fee has now become less common.

The Act requires that you opt-in to have transactions that exceed your credit limit processed before the credit issuer can apply a fee.

If you don’t opt-in, the over-the-limit charge won’t go through, but then your card company can’t charge you for it. When a user agrees to this fee, the law limits it to $35 maximum for up to two billing cycles that your balance exceeds the limit. Keeping your balance low and selecting a card with no over-the-limit fee helps avoid this charge.

*Also, read your credit card agreement and don’t opt-in to the fee.

8) Late Payment Fee

You’ll get a late fee each month you don’t pay the minimum credit card payment by the due date. Almost every card has a late fee, the first of which can be up to $27.

If this is your second one in six months, it may be as high as $38. (Fees can be adjusted for inflation.)

Some issuers may waive the first one applied to your account. You may be able to negotiate a second waiver if you don’t habitually pay late. Make sure a long time has passed since the first waiver before you try again.

The best defense against a late fee is to pay your credit card on time. If you can foresee your payment being late, call your credit card company and let them know.

If you find a credit card without a late payment fee, review the terms to determine if you should apply.

9) Returned Payment Fee (Returned Check Fee)

This is a fee applied to your account if the bank returns your credit card payment. It may be due to insufficient funds in the bank account to cover the payment. It can cost you between $25 and $35 per incident.

Returned payments can be avoided by checking your payment bank account before paying your credit card bill. If you pay your bill using AutoPay, set up account alerts to notify you when a payment will be sent.

Less Common Credit Card Fees

There are other fees that your bank may apply, per your credit card statement. An application or processing fee is a once-off fee that you pay when applying for some credit cards. You tend to find these more often on cards for customers with poor credit.

A credit limit increase fee may be applied if you ask your credit card company to raise your limit. Need a replacement credit card soon after your last credit card was issued? Your credit card company may place a credit card replacement fee on your bill.

Avoid Credit Card Fees With Our Tips

This was a review of some of the more common credit card fees that can be applied to your account. These tips can save you at least $135 in fees; not including money saved on interest from outstanding balances. Now that you know what they are, and how they are triggered, you can try to avoid credit card fees.